Muy interesante … cada vez estoy mas convencido de que el período en el que el inversor empieza a contruir su portfolio y su lugar de nacimiento ( por lo del sesgo de proximidad ) marcan la diferencia .

11 %, sin riesgo, para que luego digan que somos tontos

Que complicado es esto de los fonditos:

Yo siempre me hago la misma pregunta:

Cuando tenga algo en cartera un 50% abajo …con que estare mas tranquilo:

Con Berkshire, Altria, JNJ…o con Cobas, SIA classic o el algoritmo ese (que esta ahora tan de moda)?

Pues eso…

Las mayores fortunas familiares del mundo

Saldría buena cartera, lástima que algunas no cotizan.

Bruselas investiga a Amadeus por restringir la competencia

Michael Mauboussin rescata este artículo del psicólogo Stephen Greenspan, quien escribió un libro sobre la credulidad y palmó parte de sus ahorros en el fraude piramidal de Madoff.

There are few areas where skepticism is more important than how one invests one’s life savings. Yet intelligent and educated people, some of them naïve about finance and others quite knowledgeable, have been ruined by schemes that turned out to be highly dubious and quite often fraudulent. The most dramatic example of this in American history is the recent announcement that Bernard Madoff, a highly regarded money manager and a former chairman of Nasdaq, has for years been running a very sophisticated Ponzi scheme, which by his own admission has defrauded wealthy investors, charities and other funds of at least $50 billion.

Financial scams are just one of the many forms of human gullibility – along with war (the Trojan Horse), politics (WMDs in Iraq), relationships (sexual seduction), pathological science (cold fusion) and medical fads. Although gullibility has long been of interest in works of fiction (Othello, Pinocchio), religious documents (Adam and Eve, Samson) and folk tales (“The Emperor’s New Clothes,” “Little Red Riding Hood”), it has been almost completely ignored by social scientists. A few books have focused on narrow aspects of gullibility, including Charles Mackey’s classic 19th-century book, “Extraordinary Popular Delusion and the Madness of Crowds” – most notably on investment follies such as Tulipmania, in which rich Dutch people traded their houses for one or two tulip bulbs. In my new book “Annals of Gullibility,” based on my academic work in psychology, I propose a multidimensional theory that would explain why so many people behave in a manner that exposes them to severe and predictable risks. This includes myself: After I wrote my book, I lost a good chunk of my retirement savings to Mr. Madoff, so I know of what I write on the most personal level.

A Ponzi scheme is a fraud in which invested money is pocketed by the schemer and investors who wish to redeem their money are actually paid out of proceeds from new investors. As long as new investments are expanding at a healthy rate, the schemer is able to keep the fraud going. Once investments begin to contract, as through a run on the company, the house of cards quickly collapses. That is what apparently happened with the Madoff scam, when too many investors – needing cash because of the general U.S. financial meltdown in late 2008 – tried to redeem their funds. It seems Mr. Madoff could not meet these demands and the scam was exposed.

The scheme gets its name from Charles Ponzi, an Italian immigrant to Boston, who around 1920 came up with the idea of promising huge returns (50% in 45 days) supposedly based on an arbitrage plan (buying in one market and selling in another) involving international postal reply coupons. The profits allegedly came from differences in exchange rates between the selling and the receiving country, where they could be cashed in. A craze ensued, and Ponzi pocketed many millions of dollars, mostly from poor and unsophisticated Italian immigrants in New England and New Jersey. The scheme collapsed when newspaper articles began to raise questions about it (pointing out, for example, that there were not nearly enough such coupons in circulation) and a run occurred.

Another large-scale scandal that some have called a Ponzi scheme involved famed insurance market Lloyd’s of London. In the 1980s, the company rapidly brought new investors, many from the U.S., into its formerly exclusive market. The attraction to these new investors, aside from the lure of good returns, was the chance to become a “name,” a prestigious status which had been mainly limited to British aristocrats. These investors were often lured into the most risky and least productive syndicates, exposing them to huge liability and, in many cases, ruin.

The basic mechanism explaining the success of Ponzi schemes is the tendency of humans to model their actions – especially when dealing with matters they don’t fully understand – on the behavior of other humans. This mechanism has been termed “irrational exuberance,” a phrase often attributed to former Federal Reserve chairman Alan Greenspan (no relation), but actually coined by another economist, Robert J. Shiller, who later wrote a book with that title. Mr. Shiller employs a social psychological explanation that he terms the “feedback loop theory of investor bubbles.” Simply stated, the fact that so many people seem to be making big profits on the investment, and telling others about their good fortune, makes the investment seem safe and too good to pass up.

In Mr. Shiller’s view, all investment crazes, even ones that are not fraudulent, can be explained by this theory. Two modern examples of that phenomenon are the Japanese real-estate bubble of the 1980s and the American dot-com bubble of the 1990s. Two 18th-century predecessors were the Mississippi Mania in France and the South Sea Bubble in England (so much for the idea of human progress).

A form of investment fraud that has structural similarities to a Ponzi scheme is an inheritance scam, in which a purported heir to a huge fortune is asking for a short-term investment in order to clear up some legal difficulties involving the inheritance. In return for this short-term investment, the investor is promised enormous returns. The best-known modern version of this fraud involves use of the Internet, and is known as a “419 scam,” so named because that is the penal code number covering the scam in Nigeria, the country from which many of these Internet messages originate. The 419 scam differs from a Ponzi scheme in that there is no social pressure brought by having friends who are getting rich. Instead, the only social pressure comes from an unknown correspondent, who undoubtedly is using an alias. Thus, in a 419 scam, other factors, such as psychopathology or extreme naïvete, likely explain the gullible behavior.

MANIAS AND FRAUDS

Some financial scandals that have swept up investors over history.

ZENODOT VERLAGSGESELLSCHAFT MBH

Tulipmania

In the 1630s, tulip-bulb speculation raged in the Netherlands. Prices of some rare bulbs doubled weekly, or even daily, and rose so high that people were investing in shares of one bulb, rather than an entire bulb. The market crashed in February 1637.

LOOK AND LEARN/THE BRIDGEMAN ART LIBRARY

The South Sea Bubble

The British South Sea Co. was formed in 1711 and promised a monopoly on trade to the Spanish colonies. It lured investors with the promise of riches from abroad. Prices of shares spiked and then collapsed in 1720. Sir Isaac Newton lost the modern-day equivalent of about $1 million.

BETTMANN/CORBIS

The Ponzi Scheme

The infamous Charles Ponzi, who was based in Boston, began with 16 investors in 1919; his pyramid scheme eventually took in $15 million. In 1920 Mr. Ponzi was convicted of mail fraud and spent several years in jail.

The 419 Scam

EPA

Many email users are familiar with the 419 fraud, in which scammers (often based in Nigeria) offer a share in a large fortune in exchange for a fee. Some cases have gone to trial. In 2005, Amaka Anajemba (above center) was convicted of taking part in a scheme that defrauded a Brazilian bank of $242 million.

Two historic versions of the inheritance fraud that are equal to the Madoff scandal in their widespread public success, and that relied equally on social feedback processes, occurred in France in the 1880s and 1890s, and in the American Midwest in the 1920s and 1930s. The French scam was perpetrated by a talented French hustler named Thérèse Humbert, who claimed to be the heiress to the fortune of a rich American, Robert Henry Crawford, whose bequest reflected gratitude for her nursing him back to health after he suffered a heart attack on a train. The will had to be locked in a safe for a few years until Ms. Humbert’s youngest sister was old enough to marry one of Crawford’s nephews. In the meantime, leaders of French society were eager to get in on this deal, and their investments (including by one countess, who donated her chateau) made it possible for Ms. Humbert – who milked the story for 20 years – to live in a high style. Success of this fraud, which in France was described as “the greatest scandal of the century,” was kept going by the fact that Ms. Humbert’s father-in-law, a respected jurist and politician in France’s Third Republic, publicly reassured investors.

The American version of the inheritance scam was perpetrated by a former Illinois farm boy named Oscar Hartzell. While Thérèse Humbert’s victims were a few dozen extremely wealthy and worldly French aristocrats, Hartzell swindled over 100,000 relatively unworldly farmers and shopkeepers throughout the American heartland. The basic claim was that the English seafarer Sir Francis Drake had died without any children, but that a will had been recently located. The heir to the estate, which was now said to be worth billions, was a Colonel Drexel Drake in London. As the colonel was about to marry his extremely wealthy niece, he wasn’t interested in the estate, which needed some adjudication, and turned his interest over to Mr. Hartzell, who now referred to himself as “Baron Buckland.”

The Drake scheme became a social movement, known as “the Drakers” (later changed to “the Donators”) and whole churches and groups of friends – some of whom planned to found a utopian commune with the expected proceeds – would gather to read the latest Hartzell letters from London. Mr. Hartzell was eventually indicted for fraud and brought to trial in Iowa, over great protest by his thousands of loyal investors. In a story about Mr. Hartzell in the New Yorker in 2002, Richard Rayner noted that what “had begun as a speculation had turned into a holy cause.”

While social feedback loops are an obvious contributor to understanding the success of Ponzi and other mass financial manias, one also needs to look at factors located in the dupes themselves. There are four factors in my explanatory model, which can be used to understand acts of gullibility, but also other forms of what I term “foolish action.” A foolish (or stupid) act is one in which someone goes ahead with a socially or physically risky behavior in spite of danger signs or unresolved questions. Gullibility is a sub-type of foolish action, which might be termed “induced-social.” It is induced because it always occurs in the presence of pressure or deception by other people.

The four factors are situation , cognition , personality and emotion . Obviously, individuals differ in the weights affecting any given gullible act. While I believe that all four factors contributed to most decisions to invest in the Madoff scheme, in some cases personality should be given more weight while in other cases emotion should be given more weight, and so on. As mentioned, I was a participant – and victim – of the Madoff scam, and have a pretty good understanding of the factors that caused me to behave foolishly. So I shall use myself as a case study to illustrate how even a well-educated (I’m a college professor) and relatively intelligent person, and an expert on gullibility and financial scams to boot, could fall prey to a hustler such as Mr. Madoff.

Situations. Every gullible act occurs when an individual is presented with a social challenge that he has to solve. In the case of a financial decision, the challenge is typically whether to agree to an investment decision that is being presented to you as benign but may pose severe risks or otherwise not be in one’s best interest. Assuming (as with the Madoff scam) that the decision to proceed would be a very risky and thus foolish act, a gullible behavior is more likely to occur if the social and other situational pressures are strong.

The Madoff scam had social feedback pressures that were very strong, almost rising to the level of the “Donators” cult around the Drake inheritance fraud. Newspaper reports described how wealthy retirees in Florida joined Mr. Madoff’s country club for the sole reason of having an opportunity to meet him socially and be invited to invest directly with him. Most of these investors, as well as Mr. Madoff’s sales representatives, were Jewish. The fact that Mr. Madoff was a prominent Jewish philanthropist was undoubtedly another situational contributor.

A non-social factor that contributed to a gullible investment decision was, paradoxically, that Mr. Madoff promised modest rather than spectacular gains. Sophisticated investors would have been highly suspicious of a promise of gains as spectacular as those promised decades earlier by Charles Ponzi. A big part of Mr. Madoff’s success came from his apparent recognition that wealthy investors were looking for small but steady returns, high enough to be attractive but not so high as to arouse suspicion. This was certainly one of the things that attracted me to the Madoff scheme, as I was looking for a non-volatile investment that would enable me to preserve and gradually build wealth in down as well as up markets.

Bernard Madoff, above, walks back to his New York apartment on Dec. 17. REUTERS

Another situational factor that pulled me in was the fact that I, along with most Madoff investors (except for the super-rich), did not invest directly with Mr. Madoff, but went through one of 15 “feeder” hedge funds that then turned all of their assets over to Mr. Madoff to manage. In fact, I am not certain if Mr. Madoff’s name was even mentioned (and certainly, I would not have recognized it) when I was considering investing in the ($3 billion) “Rye Prime Bond Fund” that was part of the respected Tremont family of funds, which is itself a subsidiary of insurance giant Mass Mutual Life. I was dealing with some very reputable financial firms, a fact that created the strong impression that this investment had been well-researched and posed acceptable risks.

I made the decision to invest in the Rye fund when I was visiting my sister and brother-in-law in Boca Raton, Fla., and met a close friend of theirs who is a financial adviser and was authorized to sign people up to participate in the Rye (Madoff-managed) fund. I genuinely liked and trusted this man, and was persuaded by the fact that he had put all of his own (very substantial) assets in the fund, and had even refinanced his house and placed all of the proceeds in the fund. I later met many friends of my sister who were participating in the fund. The very successful experience they had over a period of several years convinced me that I would be foolish not to take advantage of this opportunity. My belief in the wisdom of this course of action was so strong that when a skeptical (and financially savvy) friend back in Colorado warned me against the investment, I chalked the warning up to his sometime tendency towards knee-jerk cynicism.

Cognition. Gullibility can be considered a form of stupidity, so it is safe to assume that deficiencies in knowledge and/or clear thinking often are implicated in a gullible act. By terming this factor “cognition” rather than “intelligence,” I mean to indicate that anyone can have a high IQ and still prove gullible, in any situation. There is a large amount of literature, by scholars such as Michael Shermer and Massimo Piattelli-Palmarini, that show how often people of average and above-average intelligence fail to use their intelligence fully or efficiently when addressing everyday decisions. In his book “Who Is Rational? Studies of Individual Differences in Reasoning,” Keith Stanovich makes a distinction between intelligence (the possession of cognitive schemas) and rationality (the actual application of those schemas). The “pump” that drives irrational decisions (many of them gullible), according to Mr. Stanovich, is the use of intuitive, impulsive and non-reflective cognitive styles, often driven by emotion.

In my own case, the decision to invest in the Rye fund reflected both my profound ignorance of finance, and my somewhat lazy unwillingness to remedy that ignorance. To get around my lack of financial knowledge and my lazy cognitive style around finance, I had come up with the heuristic (or mental shorthand) of identifying more financially knowledgeable advisers and trusting in their judgment and recommendations. This heuristic had worked for me in the past and I had no reason to doubt that it would work for me in this case.

The real mystery in the Madoff story is not how naïve individual investors such as myself would think the investment safe, but how the risks and warning signs could have been ignored by so many financially knowledgeable people, including the highly compensated executives who ran the various feeder funds that kept the Madoff ship afloat. The partial answer is that Madoff’s investment algorithm (along with other aspects of his organization) was a closely guarded secret that was difficult to penetrate, and it’s also likely (as in all cases of gullibility) that strong affective and self-deception processes were at work. In other words, they had too good a thing going to entertain the idea that it might all be about to crumble.

Personality. Gullibility is sometimes equated with trust, but the late psychologist Julian Rotter showed that not all highly trusting people are gullible. The key to survival in a world filled with fakers (Mr. Madoff) or unintended misleaders who were themselves gulls (my adviser and the managers of the Rye fund) is to know when to be trusting and when not to be. I happen to be a highly trusting person who also doesn’t like to say “no” (such as to a sales person who had given me an hour or two of his time). The need to be a nice guy who always says “yes” is, unfortunately, not usually a good basis for making a decision that could jeopardize one’s financial security. In my own case, trust and niceness were also accompanied by an occasional tendency toward risk-taking and impulsive decision-making, personality traits that can also get one in trouble.

Emotion. Emotion enters into virtually every gullible act. In the case of investment in a Ponzi scheme, the emotion that motivates gullible behavior is excitement at the prospect of increasing and protecting one’s wealth. In some individuals, this undoubtedly takes the form of greed, but I think that truly greedy individuals would likely not have been interested in the slow but steady returns posted by the Madoff-run funds.

In my case, I was excited not by the prospect of striking it rich but by the prospect of having found an investment that promised me the opportunity to build and maintain enough wealth to have a secure and happy retirement. My sister, a big victim of the scam, put it well when she wrote in an email that “I suppose it was greed on some level. I could have bought CDs or municipal bonds and played it safer for less returns. The problem today is there doesn’t seem to be a whole lot one can rely on, so you gravitate toward the thing that in your experience has been the safest. I know somebody who put all his money in Freddie Macs and Fannie Maes. After the fact he said he knew the government would bail them out if anything happened. Lucky or smart? He’s a retired securities attorney. I should have followed his lead, but what did I know?”

I suspect that one reason why psychologists and other social scientists have avoided studying gullibility is because it is affected by so many factors, and is so context-dependent that it is impossible to predict whether and under what circumstances a person will behave gullibly. A related problem is that the most catastrophic examples of gullibility (such as losing one’s life savings in a scam) are low-frequency behaviors that may only happen once or twice in one’s lifetime. While as a rule I tend to be a skeptic about claims that seem too good to be true, the chance to invest in a Madoff-run fund was one case where a host of factors – situational, cognitive, personality and emotional – came together to cause me to put my critical faculties on the shelf.

Skepticism is generally discussed as protection against beliefs (UFOs) or practices (feng shui) that are irrational but not necessarily harmful. Occasionally, one runs across a situation where skepticism can help you to avoid a disaster as major as losing one’s life (being sucked into a crime) or one’s life savings (being suckered into a risky investment). Survival in the world requires one to be able to recognize, analyze, and escape from those highly dangerous situations.

So should one feel pity or blame toward those who were insufficiently skeptical about Mr. Madoff and his scheme? A problem here is that the lie perpetrated by Mr. Madoff was not all that obvious or easy to recognize. Virtually 100% of the people who turned their hard-earned money (or charity endowments) over to Mr. Madoff would have had a good laugh if contacted by someone pitching a Nigerian inheritance investment or the chance to buy Florida swampland. Being non-gullible ultimately boils down to an ability to recognize hidden social (or in this case, economic) risks, but some risks are more hidden and, thus, trickier to recognize than others. Very few people possess the knowledge or inclination to perform an in-depth analysis of every investment opportunity they are considering. It is for this reason that we rely on others to help make such decisions, whether it be an adviser we consider competent or the fund managers who are supposed to oversee the investment.

I think it would be too easy to say that a skeptical person would and should have avoided investing in a Madoff fund. The big mistake here was in throwing all caution to the wind, as in the stories of many people (some quite elderly) who invested every last dollar with Mr. Madoff or one of his feeder funds. Such blind faith in one person, or investment scheme, has something of a religious quality to it, not unlike the continued faith that many of the Drakers continued to have in Oscar Hartzell even after the fraudulent nature of his scheme began to become very evident. So the skeptical course of action would have been not to avoid a Madoff investment entirely but to ensure that one maintained a sufficient safety net in the event (however low a probability it might have seemed) that Mr. Madoff turned out to be not the Messiah but Satan. As I avoided drinking a full glass of Madoff Kool-Aid – I had invested 30% of my retirement savings in the fund – maybe I’m not as lacking in wisdom as I thought.

Stephen Greenspan is emeritus professor of educational psychology at the University of Connecticut and author of the 2009 “Annals of Gullibility.” A longer version of this essay appeared at skeptic.com and will be in Skeptic magazine in early 2009.

En el blog Safal Niveshak me he topado con este artículo bastante ilustrativo que recoge algunas de las mayores estupideces que se pueden decir sobre los precios de las acciones. Basicamente las razones que nos podemos llegar a repetir para tratar de justificar una compra o una posición.

Copio el articulo completo pero agradecería que cliquen el enlace al artículo original por respeto a la fuente.

The Sixteen Silliest (and Most Dangerous) Things People Say About Stock Prices

November 22, 2018 | 38 Comments

The title of this post is inspired from Ch. 18 of Peter Lynch’s One Up on Wall Street, that reads – The Twelve Silliest (and Most Dangerous) Things People Say About Stock Prices .

For today, I have just added to and removed from Lynch’s list, and have illustrated the silliness using real-life examples of listed Indian stocks. None of what you see below portrays my view on any stock showcased in this post. These are purely examples, and that too from the benefit of hindsight. But they offer meaningful lessons.

Anyways, before you read ahead, please understand that I agree with what Morgan Housel wrote recently that people are not crazy in general. Just that they can…

…be misinformed. They can have incomplete information. They can be bad at math. They can be persuaded by rotten marketing. They can have no idea what they’re doing. They can misjudge the consequences of their actions.

I also agree with Charlie Munger who said that even smart people may have their ‘streaks of nuttiness’ that cause them to make occasional dumb remarks and decisions.

So, what follows below showcases just those moments of nuttiness and craziness that get a lot of people into problems in investing. I have experienced some of these moments myself, just that I have managed to survive to tell the tale.

Anyways, let’s get started right away with the sixteen silliest and most dangerous things people say about stock prices, but in no particular order of silliness.

Takeaway: Please do your homework, even if you’re cloning the best investors out there.* * *

Takeaway: No time is different in the stock market. History does not repeat here, it rhymes. If you take undue risks, you will be penalized. There’s no getting away from this.* * *

Takeaway: Trying to the catch the “next something” can be disastrous. Consider each business on its merit.* * *

Takeaway: One, a stock that falls 95%, first falls 90%, and then 50%. Two, cheapness in stock price does not mean value in the underlying business. Whether a stock costs Rs 1,000 or Rs 10, you still lose everything if it goes to zero.* * *

Takeaway: Avoid IPOs as a thumb rule. They are priced beyond perfection. And please avoid all mothers and fathers of IPOs.* * *

Takeaway: Don’t look at a stock’s price while making a decision. Look at the underlying business.* * *

Takeaway: Don’t torture yourself with the regret of what you’ve missed. Remember, each day is the first day of the rest of your life.* * *

Takeaway: Companies are dynamic entitites. They change everyday, and so do their future prospects. You cannot afford to buy and forget any stock.* * *

Takeaway: This is a lazy and weak argument to hold on to your mistakes and/or losing businesses. Accept reality, especially when it’s painful.* * *

Takeaway: Thomas Phelps wrote in his book – To make money in stocks you must have “the vision to see them, the courage to buy them and the patience to hold them. Patience is the rarest of the three, but with sound businesses, it pays off in the long run.* * *

Takeaway: One, a Rs 1,000 stock can be cheaper than a Rs 10 stock, as price-to-business reality is much more important that price alone. Two, there is no arbitrary limit to how high a stock can go, and if the story is good, earnings continue to improve, “can’t go higher” could be a dangerous belief to hold.* * *

Takeaway: You can never tell when a stock hits a bottom, till it goes to zero.* * *

Takeaway: To borrow from Warren Buffett, turnarounds rarely turn around.* * *

Takeaway: One, never try to make money the way you lost it. And two, if you find yourself in a hole, stop digging.* * *

Takeaway: Really? Fund managers are as human as we are. They suffer from the same biases as we do, plus more. And they are prone to make bigger mistakes than we do, because they think they cannot make mistakes.* * *

Takeaway: One, never buy a business you don’t understand. Two, especially when such businesses are run by people who seem smart and can’t seem to do anything wrong.

Final Takeaway

This is, in no way, an all-inclusive list and there are a hundred more ways to lose money in the stock market. I may someday write a book on the same.

Also, if you can relate to some of the silliness as portrayed above, don’t beat yourself for it. Take the lesson. Move on.

Anyways, what are some other silly and dangerous things people say about stock prices that you can think of? Add in the Comments section of this post.

--------------------------------------------------------------------------------

En relación a mi experiencia personal, hace muchos años compre unas acciones de SACYR a 10 euros, venía de cotizar a 40 euros, así que no podía bajar más. Aún hoy las conservo porque al final todo sube y recuperaré.

Por supuesto los de Indexa no van a ser imparciales

Que el 5% que llevan en el Nasdaq en su plan de pensiones en lugar de tenerlo todo en el S&P500 o en el Russell 1000, contribuya positivamente o negativamente a la rentabilidad final del mismo , ¿será suerte, talento o el resultado de tomar decisiones más típicas de gestión activa?

Explicaron que el no poder tener mas del 20% en ETF de la misma gestora les había hecho añadir ese.

Ya vi la explicación. Pero no era ni mucho menos la única alternativa. Será que no hay variedad de ETF para elegir.

Es algo que año tras año se repite, pero no está de más recordar en estos tiempos de turbulencias que nadie sabe lo que nos deparará el futuro. No hagan caso de los vaticinios. Muchos de ellos vienen adornados con una bonita narrativa, análisis macro, etc. destinados a convencernos, pero el futuro sigue siendo esquivo para todo el mundo.

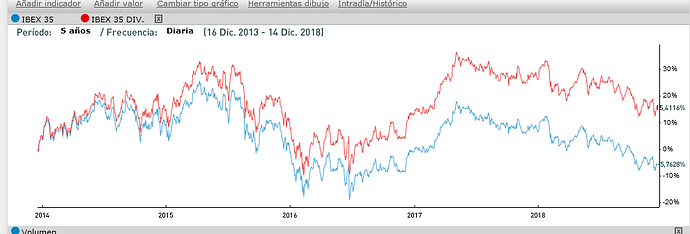

Curioso ver el efecto del dividendo en el IBEX a 5 años. Por eso los malos gestores cogen índice sin dividendo

Edito: 21 puntos de diferencia

Y en un índice donde se caracteriza precisamente por repartir mucho dividendo ni le digo.

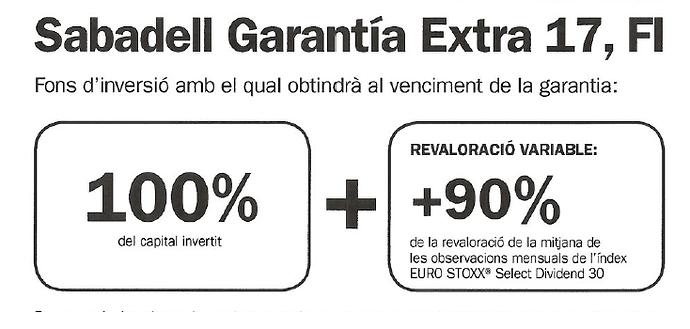

Y es ideal para montar productos garantizados donde la gente se piense que si el índice gana uno se lleva la revalorización del índice y si pierde se queda igual, si invierten los dividendos en derivados.

Aquí un ejemplo, un índice de empresas que dan mucho dividendo, sin contar el dividendo. Aprovechándose que la gente piensa que el dividendo sale de la nada.

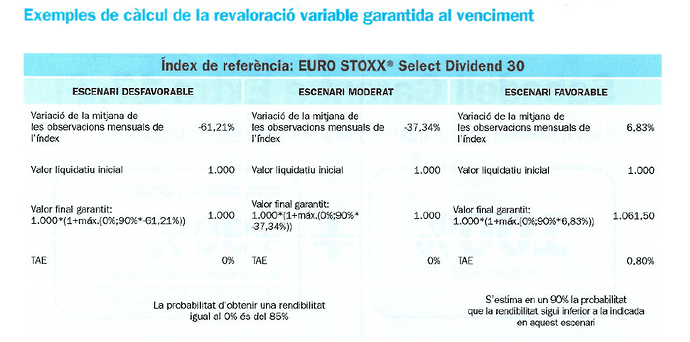

Luego pueden mirar el “reverso” del folleto sobre los rendimientos esperados. Que aún con las limitaciones que tiene la metodología de cálculo viene bien para hacer una primera ponderación de escenarios.

PD: pido disculpas por tener la ficha del producto en catalán. Pero creo que lo fundamental se entiende a la perfección con los números.

Vamos un 85% de probabilidad de que la rentabilidad sea del 0% y en un escenario muy bueno igual se llegaría a un 1% de rentabilidad.

Uff los estructurados. En tiempos, cuando hacia caso a lo que me recomendaban en la sucursal, me colocaban de eso y así me fue. Recuerdo el ultimo me vendieron era rentabilidad máx 6% y sin limite inferior

Maravillosa tabla. Y pensar que no me atrevo a debatirla con nadie en un mundo fuera del virtual y más, si les digo lo que estoy perdiendo con los values, entonces se reirían de mí.

Por eso siempre he pensado que todos deberían ser como el DAX. Por cierto, se está poniendo interesante para indexarse a él, aunque entiendo que es un riesgo localizarse en un país que no sea USA.

A mi me pasa lo mismo