Por favor, si, nos ayudaría a muchos. He invertido en ella este año y aún no he cobrado ningún dividendo pero con vistas al año que viene sería de mucha ayuda.

De acuerdo kiwu,

Aunque también iría bien saber si es cosa de la empresa Blockstone o sólo del broker DeGiro.

Es decir, tanto Carlanga como yo hemos comprado con DeGiro y hemos recibido esos 4 conceptos, pero no sé si con IB u otros brokers también sucede.

¿Tú usas DeGiro?

¡Saludos!

Revisando este tema, los dividendos de diciembre han sido tal y como comenta. Broker: IB

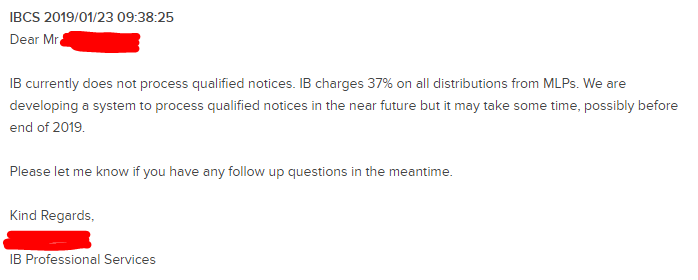

Interactive Brokers me ha dicho esta mañana que igual antes de final de año han resuelto el tema de los dividendos de las MLPs (Blackstone, Apollo, etc.)… esperemos que así sea:

Entrevista reciente a Stephen Schwarzman, habla entre otras cosas de la ventaja competitiva de Blackstone, el futuro de la firma, si van a pasar a ser una C-corp o por que no re-compran mas acciones en el mercado:

Por lo visto hay que suscribirse a esa web. ¿Alguien está suscrito, para ver las condiciones?.

Probad este link, que la noticia esta sindicada: Blackstone’s Stephen Schwarzman: ‘We see things other people can’t’

The Blackstone Group doesn’t generally suffer from the kind of shock that some investors may get when they open their most recent brokerage statements.

Blackstone specialises in locking up money for long periods in illiquid assets like real estate and private equity. The inconvenience of not being able to sell right away has its advantages, and Blackstone’s 71-year-old chairman, CEO, and co-founder, Stephen Schwarzman, isn’t shy about sharing the firm’s money-making record.

In private equity, it has made an average of 15% a year after fees since inception, and in real estate, 16%.

Barron’s recently visited Schwarzman at the firm’s Park Avenue headquarters. We asked whether Blackstone has grown too big, whether it should convert from a partnership to a regular C corporation (so the stock can be included in index funds), and about succession planning and the firm’s relations with the Saudis.

Barron’s : What is Blackstone’s competitive advantage?

Schwarzman: There tends to be a discount for large deals, because few firms in the world can do them. For example, our $20bn Thomson Reuters deal [for a majority stake in its financial-data unit]. We did that in private conversations. There was no auction. We got a chance to study the business. That’s a real advantage.

We’re one of the few firms in the world with an established brand and presence everywhere. If you’re a seller, our reputation for closing on the terms that were agreed upon is as good as it could be. We also have an exceptional bond of trust with people who give us money. In a normal year, we raise as much as our three biggest competitors combined.

How do you keep size from working against you as you grow larger and put more money to work?

Size would not work for you if you kept putting your money into the same strategy. Inevitably, your returns would go down. That happens with liquid-securities managers.

What we do is cut off a strategy at a particular size and then come up with a new strategy that’s compelling. Part of Blackstone’s DNA is to innovate, not just for the purpose of innovating, but for finding new areas that have good returns for the risk.

How do you find these new areas?

We have businesses that generate a lot of intellectual capital. That enables us to see trends and patterns and avoid risk and lean into return. We can see things that other people can’t see — not because we’re smarter, but because we have more data.

For example, in real estate, we own major asset classes all over the world. We can tell more or less without consulting anybody what’s happening economically in different locations. We also have private equity in those countries.

The real estate cycle and the private-equity cycle aren’t necessarily correlated one for one. We can get advance warnings of when something looks interesting or when to avoid it.

Some large pensions have begun to do their own private-equity investing. Is that a trend that concerns you?

There are few pension funds and sovereign-wealth funds with the size, interest, and aptitude to do those functions well. They have the handicap of very limited compensation ability. It hasn’t particularly changed our business model.

You’re making a push for retail investors and insurance money. Why?

Those capital pools are extremely large. And they’re not addressable by many organizations. We went into retail, for example, nearly 10 years ago. We hired a large staff, because once you sell something you have to service the people, and you need to put that infrastructure in place before you fundamentally have any revenue.

Most organisations find the thought of losing cash during the development period unappealing. But we looked at how retail investors didn’t have the opportunity to buy alternative assets and decided if we can develop the right products for them, it would be a win-win.

In insurance, that’s a large market with a real problem generating earnings growth. If we can increase their yield, they have a lot of money they can allocate our way. Their regulatory restrictions make them avoid the very high-return products that we have.

On the other hand, if you can increase an insurance company’s return by a half or full percentage point, or two points, that’s material. In our high-return products, that’s a very low amount of excess return.

How is your $40bn infrastructure fund coming?

We’re becoming quite busy at the moment looking at projects. I can’t say any more, just because my lawyers won’t want me to.

You’ve had a good relationship with President Donald Trump. How often do you speak with him these days?

I’m not commenting.

What’s next for house prices?

Interest rates have been going up, which constrains some of the appreciation. But I’m not worried particularly about a decline in house prices.

On the C-corp conversion, you’ve said you’re learning from the experience of others. What are you gathering?

It is interesting that inclusion in index funds seems to be working out for KKR. I think it will be interesting to evaluate things in light of this market decline to see how trading in their securities compares with ours and the other alternative managers.

What are your thoughts on recent weakness in the leveraged loan market?

We were discussing it this morning at our private-equity meeting at some length. At Blackstone, we’re the largest owner of leveraged loans in the world. We’ve had a lot of experience with this asset class, and it has been good for us and our investors. It has the advantage of typically being floating-rate, so if central banks have a bias toward raising rates, you’re insulated rather than being trapped in a fixed rate.

We went through the global financial crisis and had almost no losses in leveraged loans. So you wouldn’t think people would be overreacting in a time period like the current one where global growth is estimated to be sort of 3.5%. Nevertheless, there’s a liquidity imbalance.

Investors want liquidity from mutual funds that own these loans, forcing fund managers to sell. If there’s no one to buy, then those securities for technical reasons will gap. And that’s what’s going on. It’s leading to a repricing of those loans, and leading buyers to get a better deal than they had two months ago.

What about the attention being paid to weak covenants?

Our covenant packages have basically been about the same. In that sense, our risk has not changed. That may not be the case with everyone. One of the interesting things is that companies service and pay back debt. Covenants don’t.

Covenants allow you to better control a credit, particularly when a company gets into trouble. They allow you to stop certain behaviors, but not necessarily create behaviors. So the risk to leveraged loans is bad credit analysis.

If you have a well-trained group with excellent risk parameters and a highly predictable process for evaluating credit, then you shouldn’t be experiencing any material difference in outcomes. Particularly because this is typically senior debt.

In our firm, we do a lot of work much lower in the capital stack by buying equity-and-leverage structures. And we do very well with the equity. So worrying about senior debt historically has not been an enormous concern.

Are you rethinking taking investment money from Saudi Arabia, given its involvement in the October murder of journalist Jamal Khashoggi?

We deal with the government, and we’ve been doing that for decades. Our approach is to maintain consistent relationships.

What has changed during your time at Blackstone, and what has stayed the same?

There’s much more regulatory engagement than there was in 1985. The infrastructure for doing deals is much more developed. There are many, many more investors in alternative assets. When we started, alternatives were probably 3% or 4% of institutional holdings, and they’ve grown to 20% or 25%.

We’ve gone from just private equity to real estate, credit funds, hedge funds, and more. Each asset class is now global. The sophistication of what we do after we buy an asset is different and improved. Alternatives have become much more professional with better risk assessment. And the internet has enabled better research.

But despite all of the transparency, the returns in these asset classes have remained pretty much the same over 33 years, which in itself is remarkable.

Blackstone trades at a modest valuation. Why not repurchase stock more aggressively?

The reason we haven’t historically is that when we go into new investments, our returns are often terrific. So we’ve tried to always have a lot of money around to either buy at the right time in the cycle or to help start a new initiative. That has served us well.

The firm has grown enormously, remained under control, and delivered great returns. But we now have a share-repurchase program, and as shares look less expensive, buying becomes more interesting.

How do you feel about succession?

We have three people in senior management. Tony [James, 67] is still here. He told me he wanted to retire in his 70s and make sure somebody else is in place.

We’ve been training Jon [Gray] for three years. He became president in February, and Tony moved to executive vice chairman. So Tony still does the investment committees and other initiatives, and Jon is chief operating officer.

And the job isn’t keeping you from lowering your golf handicap or anything like that?

I don’t play golf. It takes too long. The more mature the firm gets, the more fun it is for me, because we can keep doing new things and pioneering new areas. One thing about finance: It never stays the same.

Thanks, Steve.

Write to Jack Hough at jack.hough@barrons.com

This article was published by Barron’s

Gracias por el esfuerzo @madtrad

Hola dochelio,

¿tu también te has encontrado recibiendo cuatro conceptos distintos en los, en principio, dividendos?

Los conceptos son: Rendimientos del capital, ganancias patrimoniales, dividendo y cupón.

¡Gracias!

Pues no sé a qué corresponden, recibí tres dividendos y dos retenciones por impuestos del 15% y del 25 % el 31 de diciembre. En los literales nos especifica mucho la verdad.

Buenas noches,

pues bien me he comunicado con la secretaría general de inversiones en el extranjero, aquélla a la cual hay que declarar las acciones en brokers extranjeros durante el mes de enero.

Pues bien, mi solicitud ha sido la siguiente:

Buenas tardes,

En el año fiscal de 2018 recibí unas ganancias de mis pocas acciones de Blackstone. Estos beneficios los recibí en forma de cuatro conceptos: cupón, rendimiento del capital, ganancias patrimoniales y dividendo.

Quisiera saber si debo declarar estos beneficios como si todos fueran dividendos.

¿Me podrían ayudar con dicha consulta o, en su defecto comunicarme a quién debería preguntarlo?

Muchas gracias.

Su respuesta ha sido la siguiente:

Buenos días,

Se está dirigiendo al Registro de inversiones de la secretaría de Estado de comercio. De acuerdo con nuestra normativa vigente y las declaraciones de inversiones españolas en el exterior, no tiene que declarar esas ganancias que señala. Respecto a sus obligaciones con otros organismos públicos, no puedo informarle por no ser competencia de esta subdirección.

Saludos

En dicho caso, creo que debo declarar ls cuatro conceptos como la suma de dividendos.

Ya me daréis vuestra opinión.

¡Saludos!

Al menos en mi caso, los declaro todos como si fueran dividendos.

Si aún tiene interés en alantra en este podcast la comentan (a partir del minuto 39):

Tiene casi un año pero a mi me ha resultado interesante escucharlo.

Buenas noches,

en este mes de mayo he recibido dividendos de BX con DeGiro, pero no me han cargado las retenciones.

Así que he llamado a DeGiro y me han contestado que a parte de acciones BX también tiene un % en bonos.

Me han dicho que contacte con la empresa, pero la verdad es que tampoco sé muy bien qué debo preguntar ni para qué.

¿Alguién leha pasado lo mismo? ¿Alguién podría hecharme una mano?

¡Gracias!

Hola @Wifrey_the_Hairy,

La distribución de Blackstone no son dividendos al uso, y está partida en varios tramos. Dentro de su página, vaya a Shareholders, Distributors y descárguese la distribución del último Q. Ahí verá cuanto debe retenerse según tramos.

Una empresa excepcional, sin duda,

Volviendo a escuchar los vídeos sobre Apollo y Blackstone, al César lo que es del César: comentaba el 9 de junio del año pasado @jvas que Blackstone estaba a buen precio, y desde entonces ha pasado de cotizar a 32€ a alcanzar los 45€, más los dividendos repartidos. Una pena no haber invertido en ella entonces, toca quitarse el sombrero

Me uno a la felicitación y subo a agradecimiento pues yo compré en febrero, aprovechando la promoción de ING de devolución de comisiones, a $33,37. Es la acción con la que gano más dinero en los últimos 2 años.

Gracias por acordarse, @Tiedra , pero tampoco tiene mucho mérito pues en aquel momento estaban bastante castigadas

No se preocupe, este tipo de compañías volverán a dar oportunidad de compra (vamos, que bajarán), momento en el cual se podrá aumentar posiciones. Mientras tanto, a cobrar los dividendos, que antes eran distribuciones, y ver las batallitas de estos señores que son realmente entretenidas.

@jvas tiene usted mucho mérito, mas si cabe con lo humilde que es. Sólo hay que echarle un ojo a su holding para ver que ha ido estupendamente. ¿Ha pensado en hacer un especial sobre Alantra? sería ciertamente interesante.

@Savrola me alegro mucho por usted, le deseo muchas inversiones más como esta