Pero no de la misma fecha inicial.

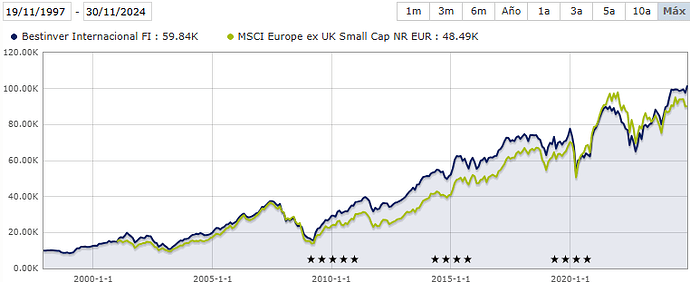

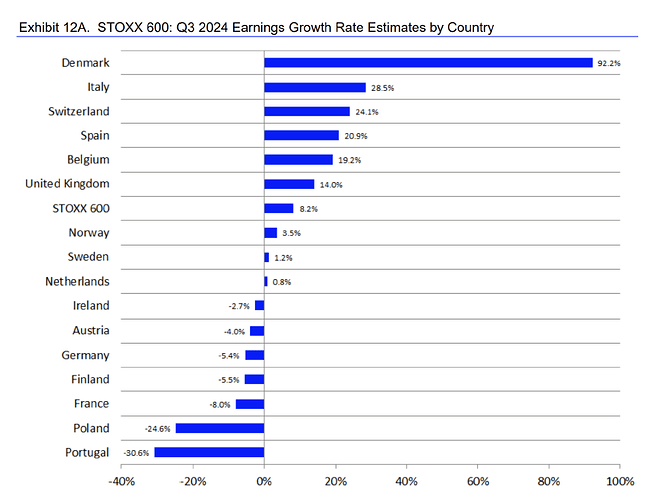

Creo que el índice disponible en Morningstar.es que mejor puede encajar en una comparativa con Bestinver es el MSCI Europe ex UK Small Cap Net Return. Este índice incluye pequeñas empresas europeas con la exclusión de Reino Unido.

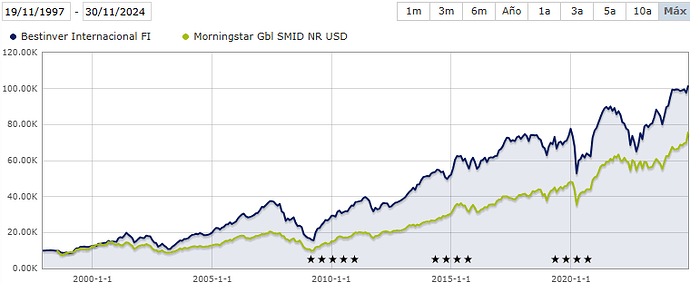

El problema es que el índice de MSCI no dispone de datos anteriores al año 2001. Así que otra opción sería emplear un índice como el Morningstar Global Small/Mid Cap Net Return, que incluye empresas pequeñas y medianas de todo el mundo (no solo europeas):

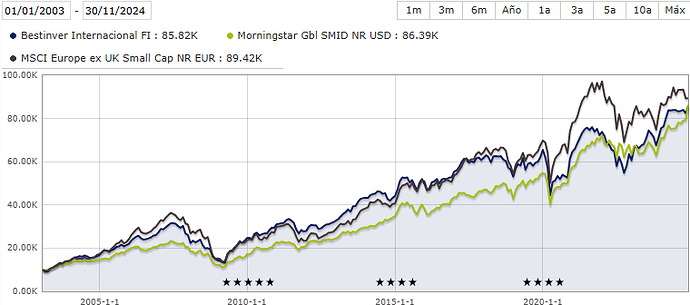

Como podemos apreciar en la siguiente imagen, la rentabilidad extraordinaria de Bestinver se obtuvo durante los primeros años de andadura del fondo. Si comparamos a partir de 01/01/2003 (tras la burbuja de las puntocom) las diferencias entre el fondo y ambos índices no son muy grandes, lo que evidencia que los primeros años del fondo fueron los que marcaron la diferencia:

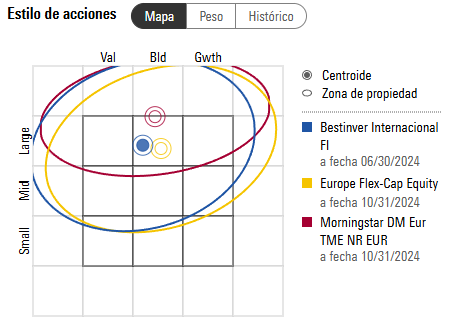

Al margen de todo lo anterior, me parece que es muy difícil comparar este fondo con un único índice porque se han producido cambios en la política de inversión durante todos estos años. Por ejemplo, según la Style Box de MorningStar, la cartera a fecha de 30/06/2024 invierte principalmente en grandes empresas y no necesariamente value.

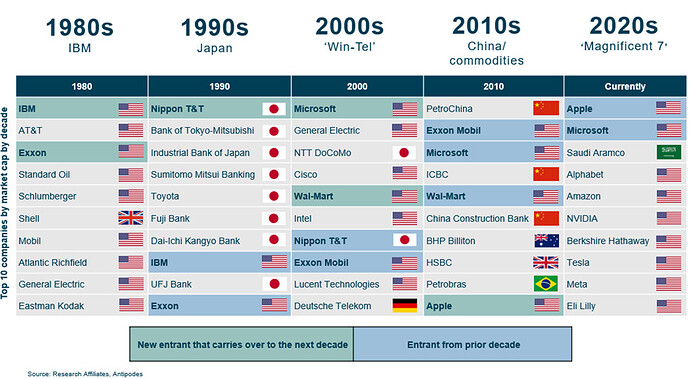

Siempre habrá un fondo de inversión o un índice concreto que ofrezcan una rentabilidad extraordinaria en un periodo determinado, pero es imposible predecir quién será el ganador de la próxima década. Recuerden que la búsqueda del próximo ganador se torna, con frecuencia, en la elección desafortunada de un perdedor.

La inversión en value (valor) y growth (crecimiento) tienen enfoques diferentes, lo que implica riesgos específicos para cada una. A continuación, te detallo los riesgos asociados a cada tipo de estrategia:

Riesgos de la inversión value

La inversión value busca empresas infravaloradas en función de métricas como el PER, el P/B (Price to Book) o el EV/EBITDA, con la expectativa de que su precio se recupere a su “valor intrínseco”. Los riesgos incluyen:

1. Trampas de valor:

• Muchas empresas parecen baratas porque enfrentan problemas estructurales o de negocio (como industrias en declive).

• Ejemplo: Empresas de energía tradicional que podrían quedar rezagadas por la transición hacia fuentes renovables.

2. Lento crecimiento o estancamiento:

• Las empresas value tienden a operar en sectores maduros con pocas oportunidades de crecimiento, lo que puede limitar el rendimiento si no se produce una revalorización significativa.

3. Falta de catalizadores:

• Aunque una empresa esté infravalorada, puede que no existan factores que impulsen su precio al alza en el corto o mediano plazo.

4. Sensibilidad a las condiciones económicas:

• Muchas empresas value están en sectores cíclicos, como la industria o los materiales, que son vulnerables a recesiones económicas.

5. Riesgo de obsolescencia:

• Algunas empresas value operan en sectores que podrían quedar obsoletos por la innovación tecnológica o cambios en la regulación.

Riesgos de la inversión growth

La inversión growth se centra en empresas con altas tasas de crecimiento de ingresos, beneficios o cuota de mercado, a menudo justificando valoraciones más altas. Sus riesgos incluyen:

1. Valoraciones infladas:

• Las empresas growth suelen cotizar a múltiplos elevados (PER, P/S), lo que las hace vulnerables a correcciones bruscas si no cumplen las expectativas de crecimiento.

2. Mayor sensibilidad a los tipos de interés:

• Dado que el valor de estas empresas se basa en ganancias futuras, el aumento de los tipos de interés puede reducir su valoración actual.

3. Alta dependencia del crecimiento futuro:

• Si el crecimiento proyectado no se materializa, los precios de las acciones pueden caer significativamente.

4. Competencia e innovación:

• Las empresas growth suelen estar en sectores de rápido desarrollo (como tecnología), donde la competencia y la disrupción pueden erosionar rápidamente las ventajas competitivas.

5. Volatilidad:

• Los precios de las acciones growth tienden a ser más volátiles, con fluctuaciones amplificadas por noticias o cambios en el mercado.

6. Ausencia de dividendos:

• Muchas empresas growth reinvierten sus ganancias en lugar de distribuir dividendos, lo que puede ser un problema para inversores que buscan flujo de ingresos.

Riesgo comparativo: value vs growth

1. En un mercado bajista:

• Las empresas value tienden a ser más resilientes porque ya están “baratas” y pueden beneficiarse de flujos hacia activos más defensivos.

• Las empresas growth suelen caer más porque sus valoraciones están más ligadas a expectativas futuras.

2. En un mercado alcista:

• Las empresas growth suelen rendir mejor porque los inversores están dispuestos a pagar más por el crecimiento esperado.

• Las empresas value pueden quedarse rezagadas, especialmente si no logran catalizadores claros.

3. Horizonte temporal:

• La inversión growth es más adecuada para quienes tienen tolerancia al riesgo y un horizonte a largo plazo.

• La inversión value puede ser más atractiva para quienes buscan estabilidad o rendimientos consistentes en el corto o mediano plazo.

Conclusión

Ambos estilos tienen riesgos significativos que dependen del contexto económico, las condiciones de mercado y el horizonte temporal del inversor. Una estrategia equilibrada podría combinar ambas filosofías, diversificando el riesgo y aprovechando lo mejor de cada enfoque.

¡Amén!

Saludos cordiales, @Camacho113.

Esto ya lo respondí yo en La taberna de los Value Investors. General - nº 2822 por Buso :

![]()

![]()

![]()

Lo que es una pasada es Chapgpt. Si el texto es generado 100% sin haberlo retocado o modificado, no me extraña que haya leído que ciertas profesiones pueden tener un impacto a corto o medio plazo.

Mi hijo me comenta que sus amigos y él mismo ya lo utilizan para componer informes, incluso algunos ya abonándose a la versión premium.

Yo sigo como siempre, ni lo he instalado ![]()

![]()

Se adapta bien lo que dice respecto a la crisis de 2000-2002 pero bastante peor a la crisis 2008.

Ahí la clave estuvo más bien en la capacidad de sostener ventas en un entorno económico de miedo generalizado y donde el endeudamiento pesó más que el múltiplo

Excelente comparativa. Nada que objetar salvo en esa afirmación en la que parece que la inversión value es más proclive a dar buenos resultados en el corto y medio plazo y el growth (y discúlpeme si no ha pretendido transmitir eso, que ya sé la “simplificación” de ideas hay que matizarla) podría ser más útil en el largo plazo. Si acertamos con las empresas de crecimiento ganadoras esa afirmación es irrefutable, pero tengo en mente los múltiples gráficos que muestran los value investors -especialmente los gestores-, en los que en el larguísimo plazo los resultados de la inversión value son superiores a la estrategia growth.

Ahora que nadie habla de OHL y acaba de entrar capital para bajar apalancamiento, ¿se atreve alguien a mirarla?

Ha sido mencionarla usted y ya se ha disparado. Cuando se plantee dar un curso o abrir un canal de YouTube le auguro un gran éxito.

Hay veces que el mercado tarda un poquillo en ver algunas cosas. La cuestión es que no siempre se acierta y tampoco se compra todo.

La mitad de lo que me planteo mirar o comento no lo compro ![]() .

.

Tenemos a +D con los 3 legendarios:

A Lynch le falta volumen en el pelo. ![]()

Buenos días y feliz año!

La acción la verdad que está por los suelos y acaban de completarse dos ampliaciones de capital. Viene de 11 veces deuda/EBITDA a ponerse a 2,5 veces. En principio eso debería hacer que aumente el FCF y entre en terreno positivo. Parece que la clave estará si después de esta recapitalización son capaces de operar la compañía con dichos ratios. La cotización da miedito, pero si empieza a escampar pues estos son los momentos de los valientes ![]()

Con estas el tema es si consideramos que en circunstancias normales el negocio requiere de cierta cantidad de efectivo por si algún proyecto sale mal (si mal no recuerdo, en su momento tenía mucha caja neta y se la comieron con patatas los balues porque se tragó la enorme caja neta -hablaban de net net- un o unos imprevistos, al estilo de Técnicas Reunidas).

Presumo que la empresa tiene también activos más estables, por ejemplo en el podcast de Elías comentaba este que tenían un % de un Four Seasons, pero si un negocio así tiene un problema gordo y te toca venderlos por tener deuda neta tampoco creo que sea prudente esperar que se vendan a precio de mercado, probablemente deberíamos esperar venderlos con cierto descuento (y la valoración iría en consonancia).

Caso de estos de escenario A multiplico, escenario B lo pierdo todo o casi todo. De las que como mínimo requieren profundizar mucho y saber al dedillo con qué activos cuenta (caso por cierto de los que creo cualquiera con decenas de miles de seguidores como es el caso de Elías, la mayoría a priori inversores no profesionales, debería sentirse incómodo de promocionar como inversión muy interesante -más aún sin incidir más en los riesgos, por los que pasa muy de puntillas-).

Yo personalmente no la compraría ni con caja neta ![]()

Buenas noches y feliz año!.

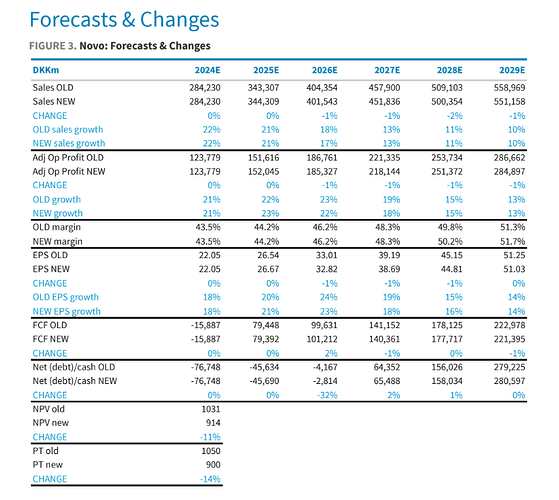

Aprovechando que estoy encerrado en casa desde el día 29, con fiebre y antibióticos os voy a dejar unos extractos de unos análisis sobre NOVO NORDISK con información de KOLs, que traducido al lenguaje terrenal son expertos en algo. Creo que es una información bastante útil que se sale de los típicos análisis, sobretodo para quien tenga tiempo y sea capaz de sacarle el jugo ya que tiene conceptos un poco complejos además de que las opiniones de ambos entrevistados distan entre si.

Además les dejo un cuadro resumen (en el final de la página) con las métricas que han actualizado después del resultado sobre el cagrisema y el clásico precio objetivo por si ustedes se quieren montar su excel para juguetear.

Espero que la disfruten y que salga un buen debate sobre el tema a quien le interese.

Notes from calls with two leading US KOLs

On Friday night, we spoke to two US obesity specialists running weight management clinics at

academic centers in the US (one on the East Coast; one in the Midwest). Their reactions to the

REDEFINE-1 data were mixed; the first KOL we spoke to noted in spite of Novo missing its own

bar, indicated that CagriSema has produced the best weight loss data we’ve seen so far in a

pivotal study and thinks it will still be a very big drug. The second KOL was more hesitant about

adding a new MOA where tolerability could be worse than tirzepatide and efficacy not demonstrably better. In our view, both these reactions make sense given we simply need to see

the full data set before coming to more definitive conclusions.

KOL #1

Our first KOL is the director of a weight and wellness clinic at at major East Coast academic

medical center in the US. His clinical practice specializes in obesity and diabetes treatment,

preventive medicine, and clinical nutrition. His public health work focuses on obesity treatment

policy and interventions for obesity and chronic disease prevention.He sits on several boards of

directors, including for the the American Board of Obesity Medicine and The Obesity Society, and

serves on leadership committees for the Endocrine Society and the American Diabetes Association.

This was a very, very positive trial. Novo’s own target of 25% weight loss probably was a little

frothy. Even before Friday, he did not think that they were going to get there. This data does

not decrease our KOL’s expectations for the drug at all; this is the most efficacious data we’ve

seen in a pivotal study.

• Our KOL believes this was the first trial where you didn’t force titrate; Novo is likely to do this

in the new P3 study they are running. We dont know for sure why Novo chose flexible dosing.

Did they want to better mimic what is done in clinical practice? In practice, we tend to not

force titration and go up slower than in the clinical trials. We often stop at less than full dose

(which can result in fighting insurance to keep the patient on a lower maintenance dose).

• Why stop at less than full dose? Patients tend to be fairly skittish about side effects. They tend

to prefer a fairly conservative approach that limits side effects.

• It is a fact that this is the most effective study; it’s just a few precent better than tirzepatide vs.

=> 5%. In our KOL’s view, the absolute delta to what we’ve seen in the SURMOUNT studies

isn’t really all that important. What is important is that this is enough weight loss and much

more than semaglutide monotherapy. This drug will get used because the obesity patient pie

is so big and options are so few.

• The decision on which drug to use now is based on a lot more factors than you would

normally anticipate; absolute weight loss is rarely the primary deciding factor. We have a

number of medications within the range of acceptable weight loss that lead to really good

weight loss (not just Wegovy and Zepbound). We consider tolerability and specific types of

tolerability. GLP-1s tend to have primarily GI side effects as the most likely side effects

whereas some others tend to have overstimulation side effects. Cost to the patient is a big

factor. Whether or not they have coverage; what the out of pocket cost is going to be. It’s not

uncommon even if they have coverage that the newer GLP-1s will cost more to the patient.

• In this KOL’s center, they use tirzepatide a lot more than semaglutide. Why? There is a pretty

big difference in weight loss. Even though the clinical trials suggest little difference,

tirzepatide is seen as being better tolerated. Furthermore, availability of late has been better

for Zepbound. It’s also easier to prescribe based on insurance coverage.

SELECT hasn’t changed the picture all that much. Medicare it opens up the potential for some

patients to be able to prescribe. There aren’t that many pts with CV and obesity in the

Medicare population. The definition also makes it limiting. Have very few patients that are

Medicare that are getting Wegovy with the CVD indication.

• OSA added to Zepbound label? Opens up another avenue for Medicare approval. Our KOL’s

strong guess is that it’s not just going to be allowed with anyone with run of the mill sleep

apnea (will need to be really severe; will have to have failed CPAP already). Payers will likely

require new updated sleep studies, a repeat sleep study 6-8m later…practically, this is a huge

barrier as his center is booked out such that they cannot get a patient in for a sleep study

before late 2025. Company trying to push for less invasive studies to allow for diagnosis and

treatment.

• With Zepbound, exceedingly few pts are on 15mg…and he is seeing a very high-risk

population. Overwhelmingly, the low and mid doses are sufficient at least in the period of

time we have been using it. Maybe we go up over time as patients plateau, but in the year or

two since we’ve been using Zepbound since the approval it’s maybe 10% of patients that

reach 15mg (if that).

• With Wegovy, the lower doses are helpful sometimes for pts, but it’s not as powerful of a

medication so it’s more likely they have to go up after 6-8m on drug. With Wegovy, only 1.7mg

and 2.4mg are approved for maintenance, so insurance can require max titration.

• Thoughts on amylin? Mechanistically, it makes sense and data we’ve seen thus far is very

positive.

• Bottom line for a clinical perspective is that for the field, our KOL does not see this as a tête-à-

tête for who has the best drug. In practice, patient volumes are limited but drug availability and how good the coverage is.

• Our KOL believes CagriSema will have a rapid launch and will have a very quick increase in

utilization. Novo Nordisk has an excellent commercial organization. From a clinical

perspective, dual chamber device doesn’t really matter.

• Before Novo got Saxenda approved, there was nervousness that an injectable medication for

weight loss would go nowhere. Pts wouldnt be willing to do injections. That pretty quickly

was squelched. Saxenda is only a modestly helpful medication, but there were many people

against using it when it was first launch. That said, most patients were fine with it as long as

they were getting a benefit. Today, patients are often willing to pay $500 out of pocket for

these medications.

• Personally for this KOL and the broader specialist community, orforglipron is not exciting at

all. It doesn’t add anything additional clinically; it’s of value only to the very small number of

patients that have phobia around needles, but that is a very small number. That said, maybe

this makes more of a difference in the primary care setting. Rybelsus is a terrible medication

and not a very effective one. Newer oral GLP-1 medications will be better, but nothing will be

anywhere near the injectables.

• We dont have enough data to say whether tirzepatide or CagriSema is a better drug; what we

can say is that these are two exceptionally good medications with a lot of overlap in

tolerability, effectiveness. Our KOL would be eager to use either of them.

• Not terribly different between the two. After the fact we’ll see responding to one and

continues.

What tirzepatide trials are outstanding that are important? T2D CVOT study, other co-

morbidity trials. Furthermore, the on the ground experience will be just as important. What happens now that there isn’t the shortage. OOP price going up or down?

• How is supply? There are still occasional hiccups, but in the past 6m it’s gotten much much

better. Even 6m ago, as giving patients a service that helps them get hard to find medications.

Often not able to get 3m at a time, but it’s around.

• Patients are paying a lot of money out of pocket for obesity drugs. A lot get coverage and

some have very low copays, but some have very high copays. Medicare pts often have to pay

$1,000.

• Our KOL strongly pushes pts against the compounded drugs. Compounded are not all that

much cheaper. We have other medications - that are not expensive like

Qsymia, Contrave, even going back to old school phentermine. These are not the best things

in the world, but they are helpful for a decent subset of patients.

• Demand from his vantage point has not slowed in the slightest.

• Historically for decades patients were not willing to use medications or extremely skittish -

afraid of side effects. Long term side effects. Regain weight really quickly or whatever. Far

more often then not that would have to try to talk patients into it. Then also had to talk

doctors into it. That that has been very, very much changing. Now try to talk patients out of it

now. Unreasonable expectations. They come in thinking it’s magic and it will solve all their

problems. Really poor media coverage. 25% of the people we see do so well without

medications that they dont need to go there - that’s what we see in clinical trials as well.

• We have consumer data going back a decade and a half showing that 15% weight loss on

average tends to be where patients get excited. Now that we have that, in the intermediate

term, getting much more is not all that important right now. Getting a much wider range of

people to get anywhere near 20% WL is by far the most important thing from a public heath

perspective. Maybe in the 2030s there will be something where we have more weight loss

maybe even mediations that have been shown to preventative - no data on that now. For the

rest of this decade, just getting anywhere near that 20% weight loss is fantastic.

KOL #2

Our second KOL is a medical educator, researcher, and endocrinologist and is an Adjunct Professor of Medical Education at a major academic research university in the Midwestern United States. Prior to his current role, he served as an endocrinologist in practice in the division of Endocrinology, Diabetes and Hypertension at a major East Coast hospital. He is board certified in internal medicine—as well as endocrinology, diabetes, and metabolism. He also has a Master’s of Medical Science in Clinical Research.

• View the data as a mixed bag. First reaction was a bit of surprise because was expecting a

higher primary endpoint figure as well. The only silver lining here is that with 57% getting to

those appropriate doses, that leaves a lot of opportunity because we know this is a dose

responsive medication and disease. There still could be a superiority advantage on efficacy…

• …but CagriSema is unlikely offer a tolerability profile as good as tirzepatide. To be a

transformative new entrant, a drug has to offer something differentiated. A couple

percentage better on weight would not be enough to advocate for a new drug if it has a worse

adverse effect profile. Using CagriSema would also mean incorporating a new MOA into

clinical practice. Given that you would uncommonly switch patients from one drug to another (save for tolerability issues), it will be very hard for a new drug to break through unless it has

a clearly differentiated profile.

Earlier stage data suggests that although most of the side effects with CagriSema are mild

and moderate, they are likely to occur with a greater frequency than tirzepatide. Frequency of

vomiting for CagriSema could be at least 20% of patients vs. 8-12% that vomit on tirzepatide.

• It’s very unlikely that a patient will choose a medication with worse tolerability profile. Expect

CagriSema to look worse than semaglutide monotherapy. That’s a problem at the get go,

unless you have a clearly differentiated efficacy advantage.

• Would expect the whole community would have some hesitation about a new MOA (and this

will likely be because of the tolerability profile).

• Have never seen a flexible dosing trial like this before…and this trial design makes it hard to

interpret the results. Can patients can down dose? Our KOL suspects that the dose flexibility

was incorporated into the trial design accommodate the tolerability. This is because not only

is efficacy dose-dependent, tolerability is as well. 20% weight loss on treatment is a strong

indicator that there’s not a whole lot of additional efficacy we may uncover. That’s why think

the 57% is a tolerability signal not an efficacy signal.

• Currently in this KOL’s clinical practice, he has a strong preference for tirzepatide over

semaglutide for obesity patients due to its tolerability and efficacy profile. Patients do very

well on tirzepatide for diabetes and obesity.

• Regarding the sourcing of drug supply, since around September, patients in our KOL’s area

have have no problem getting Zepbound.

• Knowing what we know today, would this KOL use CagriSema? He is open to being

convinced, but is not currently convinced. The combination was introduced to augment

efficacy of semaglutide monotherapy, but it was introduced in a way that modulates

tolerability. In his view, the premise of the combo is flawed given expected worse tolerability.

It’s more effective than semaglutide alone, and the GLP-1 and amylin analogues seem to be

somewhat complementary…but not in a way that differentiates it from tirzepatide.

• Is this KOL interested in an amylin monotherapy like Zealand’s petrelintide? Short

answer, not really. But this is not driven by concerns about weight loss; it is because of

concerns regarding CV risk reduction and metabolic resets. Weight loss is not the reason

specialists prescribe these drugs. Focus on a integral view on the overall metabolic state

(blood pressure, glucose). The challenge with amylin is that it doesnt impact these metrics.

See amylin monotherapies as unlikely agents for standard obesity guidelines.

• Our KOL expects the SURPASS T2D CVOT study for tirzepatide to work, it’s just a matter of

how well it works.

• Retatrutide: We’ve been learning a good deal about glucagon through these development

programs. There is a differential activity at the glucagon receptor for retatrutide vs.

mazdutide or pemvidutide. Pemvidutide data shows an absence of a glycemic response

despite substantial weight loss; our KOL views this as highly problematic.

• Retatrutide is a GLP-1/GIP receptor agonist…with a little tough of glucagon. It’s so low in

hitting the receptor that it lowers liver fat quite selectively. It does not increase the glucose

sufficiently to be a detectable signal. It lowers liver fat more than you are interfering with the

diabetes.

Obesity specialists care little about absolute weight loss. What fraction of his pts are on 15mg

of tirzepatide? 30%. It’s not 80% because it’s always about navigating tolerability v. efficacy. If

they are doing fine on 7.5mg and 10mg. Let’s not rock the boat. Don’t need to push it so hard.

Only 30% of paints need those higher doses.

• In order to get to larger volumes, the future is likely to be oral and prescribed in the primary

care setting. The patient would likely be coming in to be seen for some other kind of ailment,

as they are going out the door, envisions prescribing an oral GLP-1 if they meet the criteria.

That said, for this to happen we need a very tolerable drug, administered orally with no

fasting requirements that’ easily accessible. That’s a challenging matrix.

• If an oral offers 10% weight loss in a 9-12m window, that could be enough. Now you are

looking at low doses of some of these drugs and patients lose sufficient amounts of weight to

reset metabolism.

• This KOL expects orforglipron to fail either in clinical trials or commercially as the tolerability

is “dreadful.” He sees discontinuation rates as far too high as well as too high rates of nausea

and vomiting. As it relates to orals, he is more excited about VX2735 or CT-996. When asked

about CT-996’s tolerability from the P1 presented at EASD, our KOL believes they tried a

“reasonable” titration program and that that will be modulated sufficiently in later trials.

• Will orals be successful? Prices are going to have to be under pressure and their uptake needs

to be supported by public health declarations.

• Patients are motivated to stay on these drugs. 3m discontinuation rate in real world is

probably in the 10-15% range (when the data in the clinical trial setting suggests its <5%).

• In our KOL’s practice, 80% of patients are on drug at 9m. Between 9-18m it’s down to 30%

staying on drug. Reason for that is vast majority of pts reach a plateau. High cost and stable

weight; patients abandon the drug. If you can solve the cost issue, he sees stay time as

extending much longer. Patients don’t want to go off these drugs, they just don’t want to pay

for it.

• Routinely patients are having to pay very high copays for obesity. OOP for T2D is way way

better - $25. T2D patients stay on drug and they measure their blood sugar routinely. They

stop for a week or two; they go back on medicine.

• The weight regain is half the rate of the weight loss. Already seeing patients who have started

to regain weight back coming in (also need to acknowledged that patients don’t want to be

going to an obesity clinic). The challenging thing is that when weight yo-yos, you lose any

advantage of the metabolic reset.

• Zepbound has better coverage - 6m it’s abundantly clear that tirzepatide has better coverage

amongst payers.

• Probably wouldnt use oral - across 3-4k specialist prescribers. We are referred by the heavier

patients where efficacy is likely to be more important.

What other MOAs excite this clinician?

MariTide; have an open mind to that. Their blood pressure data and lipid data is quite

disappointing. Antagonizing GIP - if you do that do you not protect the pt from CV disease.

Early data was fantastic…later data not so much. Especially curious that patients withdrew

for personal reason - was highly imbalance between the treatment and placebo - could be

AE profile is more problematic.

Amycretin doesn’t have the same profile as CagriSema and early data has been

interesting…but we dont know much about it

Curious about CB1 - don’t think it’s going to make it because of CNS safety concerns. Need

these to act in the periphery.

PYY is too nauseating.

Bimagrumab doesnt seem to have a functional component - increasing muscle mass is not

yet demonstrated. New agents that may achieve power advantage.

Muscle waiting is not a clinical concern. Patients losing weight in these medications are losing

60/40 fat / lean body mass - as long as that’s over 50%, your power advantage is total muscle

to total body mass - as long as more fat than muscle your power is greater.

• Don’t think MASH is going anywhere - GLP-1s are working so well in MASH we dont really need liver specific - CV disease is the primary cause of death in MASH patients.

Sesudo análisis, aunque he de reconocer que no me lo he leido entero.

De todas formas, valoro más la opinión del primer KOL (me imagino que significa Key Opinion Leader) ya que parece que está mucho más involucrado en la práctica clínica, mientras que el segundo parece más teórico.

Me da la impresión que el mercado ha sobrereaccionado, aliviando un poquito las altas valoraciones de NOVO, por lo que para mí es una oportunidad de compra.

Al fin y al cabo, como indican, la eficacia de cada medicamento no es una constante inalterable y, ni mucho menos, es el punto más decisivo a la hora de prescribir el medicamento por parte de los médicos ni de utilizarlo por parte de los pacientes.

saludos y que se mejore!

Estaba escuchándome de nuevo esta entrevista a Miguel Rodríguez de Horos, y justo hablaban de OHL, de las dificultades del negocio constructor y de cómo ciertos equipos directivos te la podían colar en la contabilidad (que por ejemplo eran mucho menos piratas en esto de la contabilidad, dicho con palabras mías, los directivos de Ferrovial frente a los de OHL) . A partir de la 1º 44’ 55’'.