Pues tras la última castaña la tenemos ya cerca de precios de hace 5 años, cuando la empresa estaba en una situación mucho peor.

Crocs como un cohete:

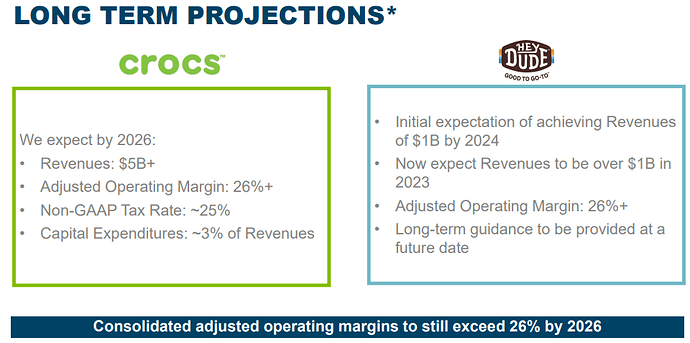

Financial Outlook

Full Year 2022

With respect to 2022, we expect:

- Consolidated revenues to now be approximately $3.455 to $3.520 billion, representing growth between 49% and 52% compared to 2021.

- Crocs Brand revenues to now be $2.605 to $2.630 billion, implying approximately 17% growth on a constant currency basis, and approximately 13% growth on a reported basis.

- HEYDUDE Brand revenues to still be approximately $850 to $890 million on a reported basis, implying $940 to $980 million, including the period of time prior to the closing of the acquisition.

- Adjusted operating income to now be approximately $920 to $950 million and adjusted operating margin to be approximately 27%. This excludes non-GAAP adjustments primarily related to the HEYDUDE acquisition and integration of $75 million in cost of sales and $55 million in SG&A.

- GAAP tax rate of approximately 25% and non-GAAP effective tax rate to now be approximately 21%.

- Adjusted diluted earnings per share to now be between $9.95 and $10.30.

- Capital expenditures to now be approximately $150 to $170 million, primarily for supply chain investments to support growth.

Long-Term Projections

We expect:

- Crocs Brand revenues to still be $5.0 billion by 2026.

- HEYDUDE Brand revenues to now be over $1.0 billion in 2023.

- Consolidated adjusted operating margins to still exceed 26% by 2026.

- Gross leverage to still be below 2.0x by mid-year 2023 following strong earnings and cash flow expectations for 2022.

Como aproximación igual le interesa: https://twitter.com/ProfesorDiv/status/1546143932555444225?t=gkeHK-azI8q5yCpGCodUuQ&s=19

Pues ahora que ha recortado el dividendo como un 50%, imagino que irá saliendo de todas las carteras de “los inversores DGI”.

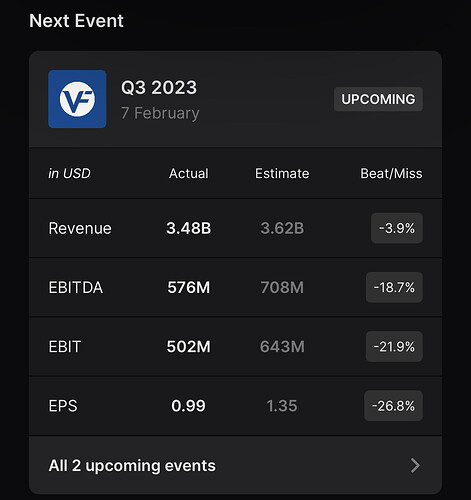

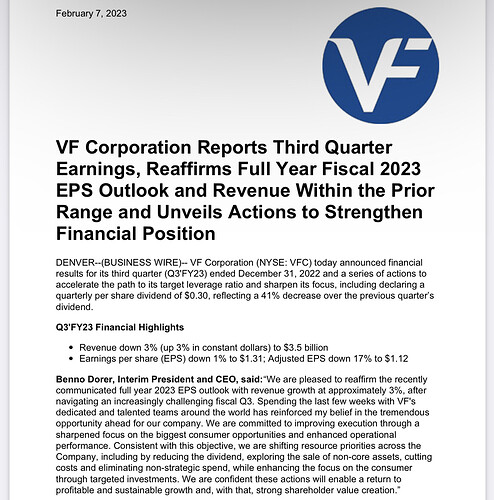

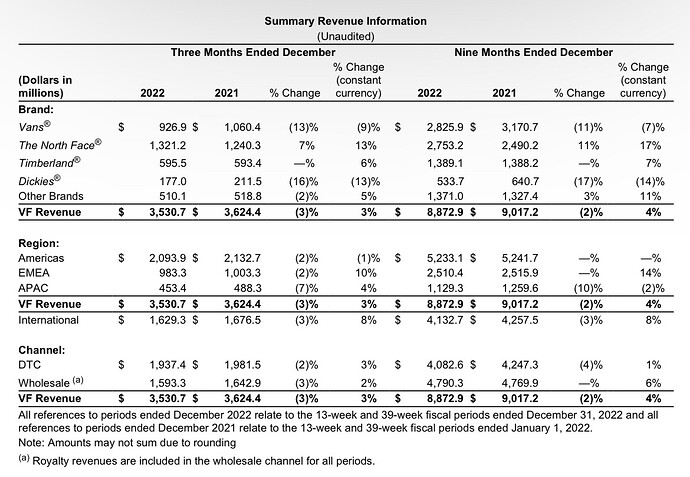

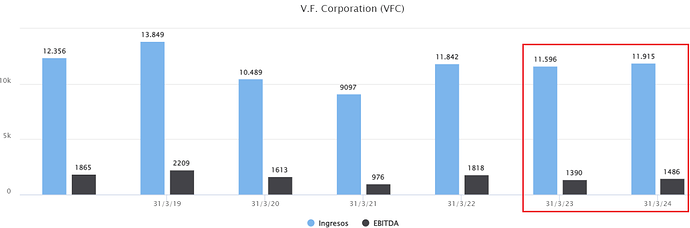

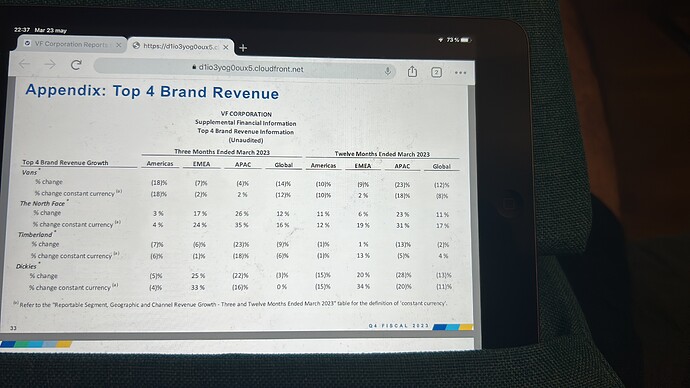

¿No sé está pasando de frenada el mercado con VFC?

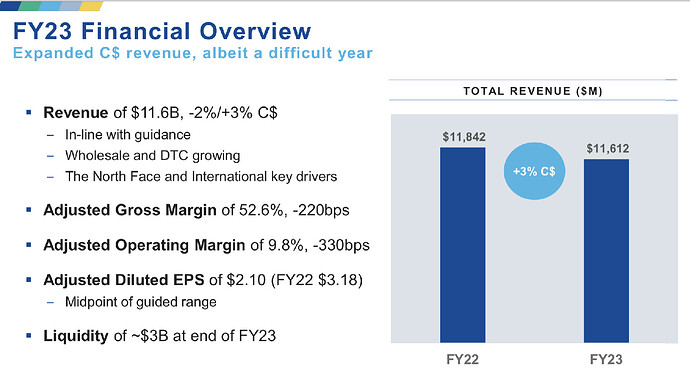

Ha sido un año duro para el sector, en el que destaca sobremanera nuestra maravillosa Inditex. Pero, ¿qué queda por venir que pueda hacer tanto daño a marcas como The North Face o Vans? ¿Tanto va a lastrar esa deuda?

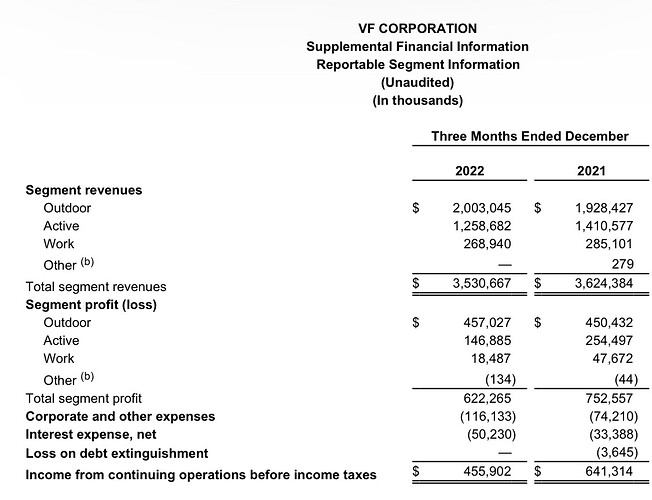

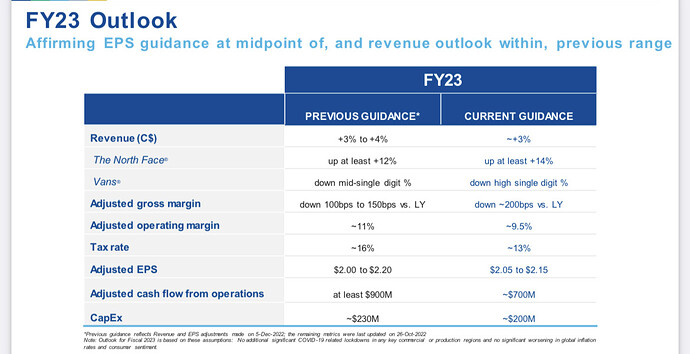

Pues VFC realmente sí que está bastante afectada y el castañazo está justificado. Otra cosa es que tenga sentido que a perpetuidad vaya a seguir así, tal y como descuenta el precio.

Tanto por inflaciones como por volúmenes está sufriendo bastante.

El mercado hasta que no vea cierta visibilidad en ella la va a mantener bastante seguro a estos niveles.

Estimaciones de VFC según el mercado:

¿Muy pesimistas tras los castañazos que se ha pegado en resultados en los últimos trimestres?

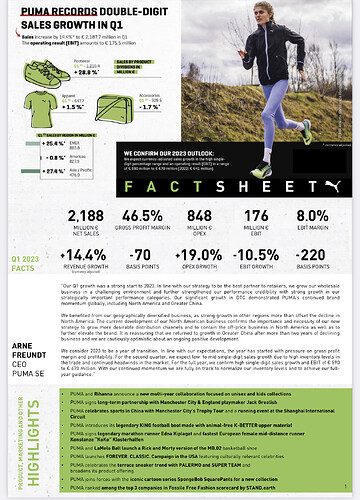

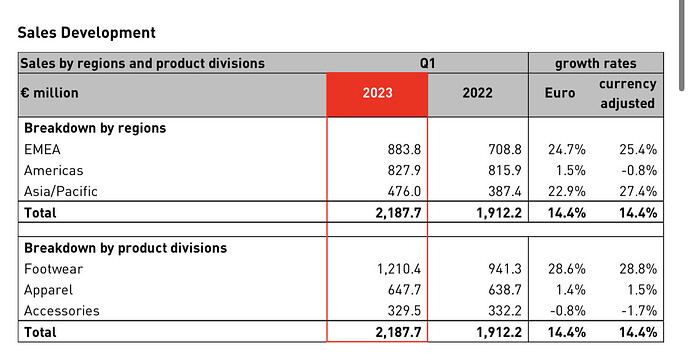

¿Alguien conoce el motivo de las caídas de hoy de Nike, Puma, VFC y Adidas? Por supuesto Inditex no.

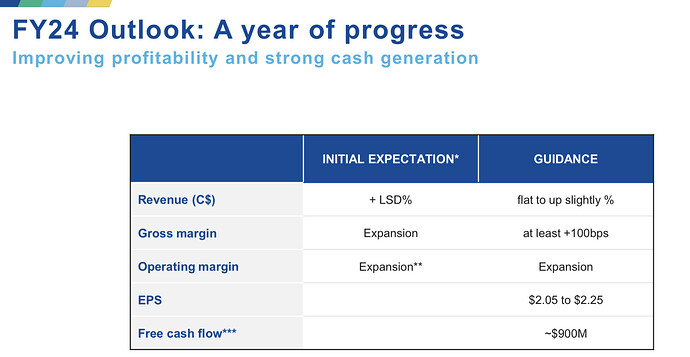

Estoy esperando ansioso la próxima presentación de VFC, a ver si mejora en línea con la macro. Si empieza a dar muestras, este año puede ser bueno para sembrar.

Están zurrando a todas a la vez, por lo que entiendo que alguna casa grande habrá sacado un informe diciendo que el retail va a sufrir por el inicio de la crisis.

Tactical asset allocation lo llaman.

Creo que he descubierto el motivo por el cual zurraron al retail

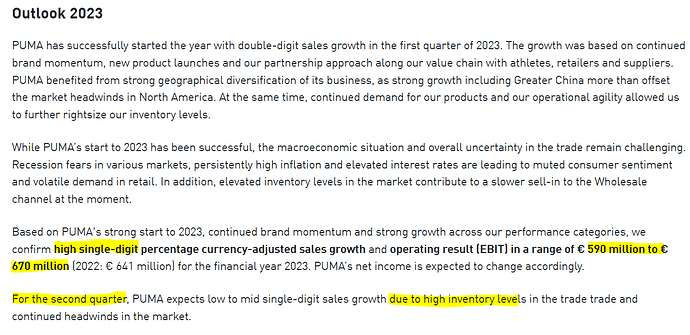

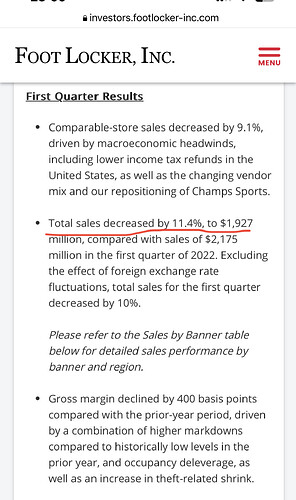

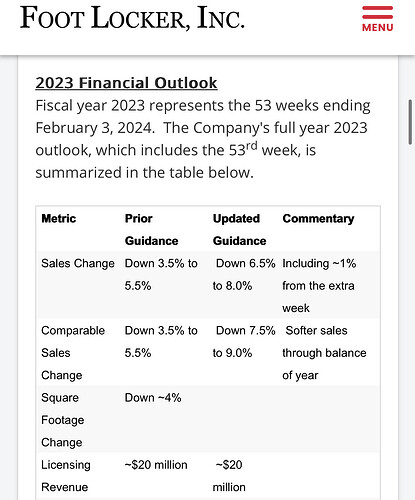

Se vienen caídas en ventas.

Bajan guidance aún más ![]()

¿Otro indicador técnico secreto?

El perras earnings de toda la vida ![]()

Jurdeles Incoming lo llamaba Adam Smith.

Cierre del año de VF:

Guidance:

El precio está lo suficientemente abajo como para que se pueda comprar a estos niveles.

Buen castañazo en Vans que veremos si no es estructural.

La pregunta que yo me haría:

¿Cuánto han caído los volúmenes?

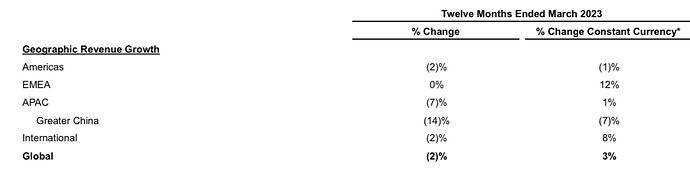

Lo peor Asia:

No obstante, son optimistas con Asia.

![]() Greater China saw increasing momentum throughout

Greater China saw increasing momentum throughout

the year with Q4 revenue +10% in C$

![]() We are currently investing and will continue to invest

We are currently investing and will continue to invest

into the momentum

![]() APAC and Greater China revenue anticipated to grow

APAC and Greater China revenue anticipated to grow

double-digits % in FY24

![]() Significant long-term growth opportunity

Significant long-term growth opportunity