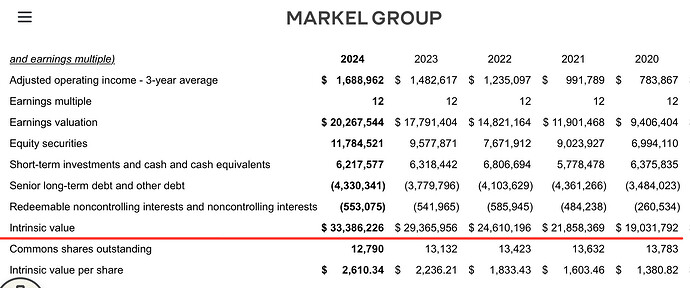

Ejemplo de cómo Markel valora su propia empresa:

Markel Group Inc. and Subsidiaries

Supplemental Financial Information

Growth in Intrinsic Value per Share

Management uses the five-year compound annual growth rate (CAGR) in intrinsic value per share as a way of measuring long-term performance. Growth in intrinsic value offers a view of Markel Group’s value over time and serves as a starting point for assessing shareholder returns in comparison to our stock price. As a financial holding company, we use intrinsic value as a measure to help us evaluate the value created by our diversified set of businesses over long periods of time. While it does not represent a precise valuation of our business or a sole factor in making capital allocation decisions, intrinsic value is useful to investors and helpful to management in understanding long-term value creation trends.

We use a straightforward methodology to measure intrinsic value that can be recalculated from our financial statements, as detailed in the tables below. Our calculation of intrinsic value is performed in two steps.

First, we take the operating earnings from our three engines – insurance, Ventures, and investments and apply a multiple to arrive at an earnings valuation. We exclude certain non-cash items, such as amortization, as well as income attributed to our public equity portfolio, which is valued separately in our calculation. We apply a multiple of 12 to a three-year average of the calculated earnings. This multiple was selected as it falls within a conservative range when considering the sources of our cash flows. Using a three-year average of earnings helps normalize the impact of cyclicality and non-recurring items to provide a broad measure of earnings-based value.

Second, we add certain items from our balance sheet that are not included in the earnings valuation. The balance sheet component of the valuation consists of adding cash, short term investments and equity securities, then subtracting debt and noncontrolling interests. The sum of the earnings and balance sheet valuation divided by the number of shares outstanding represents our estimate of intrinsic value per share.

Given its simplified nature, this calculation should be viewed as a directional indicator rather than a precise valuation. As of December 31, 2024, our intrinsic value estimate was $2,610 per share, reflecting an 18% five-year CAGR, compared to a 9% CAGR in our stock price. While the five-year CAGR of intrinsic value provides an initial view of value creation, we consider additional factors in evaluating shareholder returns and making capital allocation decisions.

Esto es la inversa de cómo llegar al equity value, aplicando un múltiplo a un beneficio y luego sumando la caja y restando la deuda.

Pregunta general:

¿Es justo quitar los minoritarios a valor contable como se hace siempre en todas las valoraciones?