Don Dani, yo no lo hubiese dicho mejor.

Desde 1992 sin rotar una accion:Cognex …rota de media 1 cada 10 años.

Debería estar prohibido ser tan vago a la hora de invertir…encima cobrar por ello.

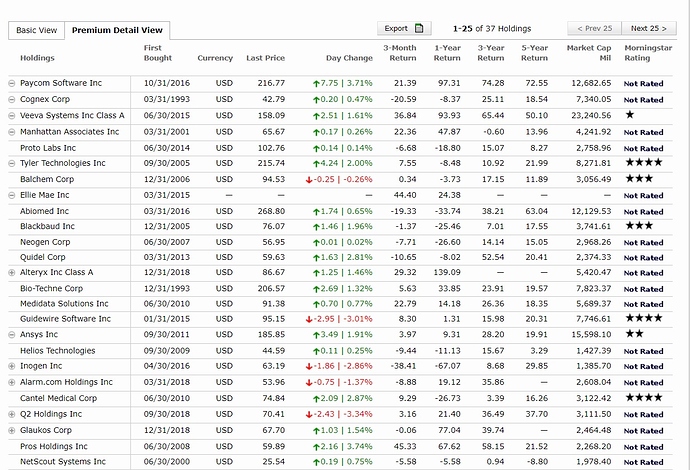

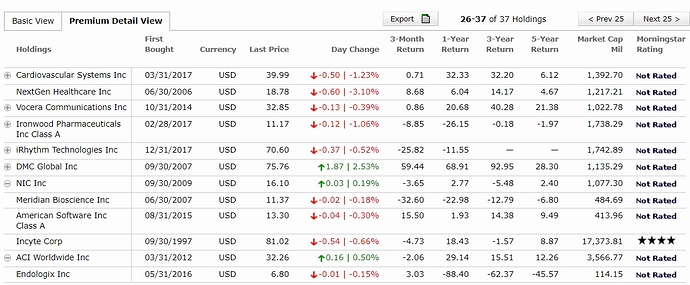

Cartera actual:

Análisis Morningstar:

Brown Capital Management Small Company’s team continues to execute one of the industry’s more unique approaches to small-growth investing, earning a Morningstar Analyst Rating of Gold.

This fund’s management team, led by longtime manager Keith Lee, uses an approach that looks different from the crowd. For one, rather than filtering candidates by market cap, the team focuses its purchases on companies with durable business models and annual operating revenue of around $250 million or less. This leads to a fund with relatively high-quality characteristics–the portfolio’s average net margins and returns on capital are better than peers in the small-growth Morningstar Category, for example–but the focus leads to a niche and at times expensive portfolio. As part of their screening method, the team searches for firms that save lives, time, money, or headaches, which results in a particularly technology- and healthcare-heavy portfolio with combined sector weightings nearly double that of the Russell 2000 Growth Index. Additionally, these picks come at a price, with the fund’s price ratio metrics typically twice that of its bogy. These biases can make for tumultuous short-term experiences for shareholders, but over the long term, the fund has been remarkably consistent, thanks in part to its consistent team.

The fund’s six-member management team is experienced. Lee and a fellow comanager have been involved since the fund’s 1992 inception. Apart from the firm’s founder stepping down, the team has seen just one departure. This continuity and a long-term investment approach–annual turnover tends to stay below 20%–have helped produce superior results. The fund has easily surpassed both the Russell 2000 Growth Index and small-growth category average from inception through July 2018 and has beaten both in all 10-year rolling periods. Plus, the fund has lost less in down markets. While this low-turnover approach has introduced style creep, as the fund’s small-cap picks have turned into mid-caps, the fund, which is closed to new investors, remains a stalwart growth option.

Process Pillar: Positive | Christopher Franz, CFA 08/21/2018

The team uses an uncommon approach to investing in the small-growth space, generally narrowing its investment universe to firms annually earning around $250 million or less in operating revenue rather than those fitting a specific market capitalization. The managers focus on firms with growing and durable revenue streams, strong balance sheets, and defensible competitive advantages, which typically leads to a portfolio with higher-quality characteristics. They invest for the long haul, as evidenced by the fund’s low annual turnover ratio and nearly nine-year weighted average holdings duration as of June 2018. The team aims to stay fully invested and doesn’t attempt to time the market by tactically rotating into or out of cash. The group’s consistent execution of this unique approach merits a Positive Process rating.

Eschewing the usual Russell GICS sectors, the team classifies companies into six investment areas. They include business services, industrial products and systems, and medical/healthcare (typically the largest component), each of which must stay under one third of fund assets. This leads to a portfolio heavy in technology and healthcare stocks, but light in areas such as consumer stocks, which the team says doesn’t fit its revenue and high-quality criteria given what it deems consumer fickleness. This type of concentration bears sector-specific risk but has been consistent throughout the fund’s successful past.

The team’s unique investment approach leads to a portfolio with distinct characteristics. In addition to the fund’s outsize technology and healthcare stake–a combined 86% of assets as of June 2018 compared with 46% for the Russell 2000 Growth Index–its price metrics appear much higher, and the team’s preferred names don’t trade cheaply. Indeed, many of the fund’s trailing price ratios, such as P/E and P/S, land at the top of the small-growth category and are more than double the index. Still, the fund’s emphasis on quality shines through, as it has markedly higher net margins and returns on assets, and lower debt/capital ratios compared with the index and peer group. Given the team’s low-turnover investing style, these characteristics have remained fairly constant throughout the fund’s history.

The managers sometimes let their winners run and won’t necessarily sell companies when their market caps reach certain thresholds, focusing more on revenue levels. This runs the risk of the fund holding stocks as they become expensive and may allow the fund to stray out of small-cap territory. Indeed, as of June 2018, the fund’s $4.3 billion average market cap was double that of its index and at the top of its peer group. Still, the team has stuck to its sell discipline, selling five stocks out of the roughly 40-stock portfolio in 2018 through June, citing revenue levels that were above the team’s threshold.

Performance Pillar: Positive | Christopher Franz, CFA 08/21/2018

This fund’s preference for higher-quality stocks has handsomely paid off over its 26-year history. From its 1992 inception through July 2018, the fund’s 13.1% return handily beat the Russell 2000 Growth Index and small-growth peers, which returned 8.8% and 10.6%, and the fund’s risk-adjusted returns were superior as well. It receives a Positive Performance rating.

Still, given the team’s low-turnover, benchmark-agnostic approach, it’s not uncommon for the fund to stray from these expectations. For example, its higher-quality bent kept the fund ahead of 97% of peers in 2008’s downturn (albeit with a 30% loss), but it also ranked in the group’s top quintile in 2009’s more speculative market. The fund’s relative results in 2014 and 2016 serve as a reminder that deviations can go the other way as well. Its customary heavy weighting in technology and healthcare-related stocks greatly contributed to its lagging most peers in the rocky markets that marked those years. The fund’s sector biases and higher-quality characteristics helped it fall in line with expected performance patterns in 2015, when the fund’s 8.8% gain outpaced almost every competitor in the small-growth space. These same biases provided the fund a tailwind in 2018’s growth-led market, as it was 6 percentage points above its bogy and peers through July. Longer term, the team’s focus on high-quality companies has kept relative volatility in check, leading to attractive risk-adjusted returns.

People Pillar: Positive | Christopher Franz, CFA 08/21/2018

The experience and stability of this fund’s six-member management team merit a Positive People rating.

Firm president Keith Lee leads the group and has spent nearly all of his 32-year investment career at Brown Capital. He was instrumental in launching the fund in 1992 and has been an important contributor to its long-standing record of success. Comanager Robert Hall’s tenure also dates to the fund’s inception, although at age 85, his day-to-day involvement has decreased. They are joined by veteran comanager Kempton Ingersol, a manager since 2000, and more recent additions Damien Davis and Andrew Fones, who were listed as managers in 2013 and 2014, respectively. The team lost a comanager in 2015 when Amy Zhang, listed manager since 2002, left to run her own fund at Alger. Zhang’s departure was the first true personnel loss for the team. In response, the firm promoted from within, adding Daman Blakeney from its mid-cap team. All together, the team, which makes collective investment decisions, averages 26 years of industry experience, 17 of which are with the firm.

While the team’s depth and experience are reassuring, their personal investments in this fund remain disappointing. Each member is a firm owner, helping to align their long-term interests with shareholders, but higher levels of ownership within the fund itself would be encouraging.

Parent Pillar: Positive | Christopher Franz, CFA 08/20/2018

Brown Capital Management is transitioning to a new generation of leaders. The firm, founded in 1983, converted to an employee stock ownership plan in 2017, and now all employees are owners. Founder Eddie Brown relinquished the role of president to veteran portfolio manager Keith Lee in 2012 and is divesting his ownership internally. The Baltimore boutique offers domestic and international strategies, but more than 80% of its $11 billion in assets are invested in its flagship small-cap strategy, which was closed to new investors in 2013, highlighting the firm’s discipline and investment-first culture.

Apart from the small-cap fund, the firm’s other offerings don’t stand out. Much smaller in nature, they feature less-compelling track records and are managed by separate investment teams that have seen turnover. Brown Capital Management is shifting focus and resources to those strategies, investing in their management and analyst teams with external hires. The firm recently overhauled its compensation structure, installing an uncommon bonus system that pays out only once every three years, determined by better-than-benchmark performance. Overall, compensation is still tilted toward base pay and equity ownership, which should help keep the investment team focused on the long term. The firm’s commitment to keeping the small-cap fund’s capacity intact and the small sizes of its other funds mean expenses tend to be above average.

Price Pillar: Negative | Christopher Franz, CFA 08/21/2018

This fund, which has been closed to new investors since October 2013, features two share classes, both of which levy above-average investment expenses relative to their small-cap peers. It receives a Negative Price rating.

Despite the expensive price tag, fees are moving in the right direction. Both share classes lowered fees by 2 basis points in 2018: the Investor share class to 1.26% and Institutional share class to 1.06%. These decreases are encouraging, but the fund’s fees still have room to fall.

Buenos días, hoy que empecé el día más tranquilo y aquí ando leyendo vuestros comentarios. JordiRP, muy buena lista de la compra la tuya, me gusta el plan. Y como decían en el equipo A, me gusta que los planes salgan bien y ese seguro lo saldrá. Me gustaría saber si no es mucho preguntar. ¿Qué cantidad estimas conveniente para hacer esa compra semestral?, puede ser un rango no una cifra exacta para optimizar también las comisiones de compra. Empleas todo el saldo en cuenta para hacer esa compra o guardas algún remanente de liquidez para bajadas del 10% como dice Quixote al cuál si me lee también hago estas preguntas. Y la última, cuando cobras dividendos de una empresa extranjera en ING por ejemplo MCD, a la hora de convertir esos dividendos en dólares a euros, ¿te cobran también la comisión de cambio de divisa como en las compras y ventas?. Que tengáis un buen día, cada día aprendo más en esta comunidad, gracias a todos.

En lo que a mi respecta,esto pretende ser un diálogo socrático en el que se dan recetas ,herramientas y cada cual prepara su potaje.

Es dificil e irresponsable dar consejos concretos.

Cada uno tiene que ir año a año afinando el “instrumento”.

La receta mas o menos es la siguiente:

1.-Buenos negocios… pudiendo elegir ,quien quiere los malos (a mi me costó muchos años entender que los buenos y archiconocidos patean a los demás por goleada).

2.-Dirigidos por y para el accionista.Si esta el fundador detrás (o incluso sus herederos ) mejor …De que viven los del consejo de administración ;de esquilmar al accionista o de su paquete de acciones…"skin in the game " , gracias @jvas .

3.-Tratar de no pagar demasiado …pero como es lógico , la calidad, hay que pagarla.

4.-No hacer nada …es de los pocos trabajos ,en los que hacer nada esta tan bien pagado.

5.-Disciplina automatica: De ahorro , de compras.

Lo de mantener esta tan bien pagado que todos los años (si, en 2008 también) ,a uno le suben el sueldo (dividendos) …y no hay ni que ir a trabajar .

Encima el tipo marginal esta lejos del 48% (a Dios gracias).

Me gusta mucho su estrategia @quixote1, es de una simplicidad y una lógica absoluta. Lo simple suele ser lo mejor en todas las facetas de la vida. Gracias por compartir su sabiduría adquirida con los años.

Debo reconocer que usted y otros insignes foreros me han hecho cambiar la forma de ver las cosas, y no es que yo haya cambiado mi estrategia, pero si que la he ampliado y completado. El punto 3 (tratar de no pagar demasiado) es lo más complicado evidentemente. Pero con el tiempo se van abriendo ventanas de oportunidad (ahora mismo Bayer, PM, MO) y es cuando hay que lanzarse.

Lo entiendo perfectamente y agradezco su respuesta, además como suele ser habitual en un tiempo récord jejeje. Lo último si me gustaría que algún forero me lo aclarase lo del tema del cobro de dividendos en ING para acciones extranjeras. Te hacen el cambio dólar euro únicamente llevando a su favor el tipo de cambio o también te cobran la comisión de cambio de divisas como en las compras, muchas gracias.

Lo pongo aquí pero no sé realmente si sería el sitio correcto, si lo consideran oportuno, muévanlo donde sea.

Bayer va a dejar de cotizar en España:

https://www.cnmv.es/portal/HR/verDoc.axd?t={7a61f39a-fecc-4636-8456-15aead89ad18}

Pena …de lo mejor del continuo!

Vaya faena… @maa Marcos creo q la comentamos el otro día, q Vd como yo la llevamos en el continuo español.

Si le puedo preguntar qué va a hacer Vd al respecto?

Sorprendentemente ING no cobra comisión de cambio de divisa en el pago de dividendos de acciones extranjeras.

En la compra y venta de la acción si que aplican un 0,5 %.

Pues si… no lo entiendo demasiado bien, pero por lo que entiendo en el documento, no hay otra opción más que venderlas.

Lo necesario para mantener la posición.

4_6039880901976917277.pdf (35,0 KB)

Trataré de hacer algo fiscalmente si aplica y merece la pena, y poco más.

Me resulta algo confusa la información.

Si no quiero venderlas, qué ocurre?

Yo las compré con el broker de ING. En caso de querer deshacerme de ellas, cómo proceder?

Saludos

Por mi parte he escrito a DeGiro para saber cómo proceder en caso de querer mantenerlas y la verdad es que no me han resuelto nada. Les dejo la respuesta que me han dado:

Estimado inversor,

Por el momento, y con la información actual, una vez las acciones queden excluidas no pasarán a la bolsa de Frankfurt. Todavía desconocemos si será posible traspasar su posición a Frankfurt, así como el coste que conllevará.

Un saludo

Hablando de Compounders se podrría considerar a Viscofan una candidata tras dos trimestres decepcionando con sus resultados, algún dato:

- Está a casi un 30% de sus máximos que fueron en Septiembre de 2018.

- PER en 18-19 puede echar para atrás.

- Rentabilidad por dividendo 3.50% aprox

-…

¡Este tipo de inversiones un tanto incómodas pueden ser acertadas a medio-largo plazo?

Muchas gracias, esperemos que no les dé por cambiar. Un saludo.

Yo he comprado Viscofan, @Especulata. Espere con el gatillo dispuesto, que seguro se derrumba en breves.

Estoy valorando varias opciones para la segunda quincena de Junio(máximo dos valores) y si la bolsa se dispara y no veo precios apetecibles tengo en mente Pigmanort Sicav, que es el Buy and Hold flexible a través del Mab con ING y poca comisión para entrar.Vigilo REE, Enagas, Grifols(la comenté anteriormente en algún hilo y se escapa), Ferrvoial, Airbus, Boeing, BATS, Altria, PM, Abott, Naturgy, BRK-b, Markel, Boskalis, Semapa, Ibersol y alguna otra más.