jaja qué agudo @scribe no sabía ni había mirado que también lo publicaran en la web, pensaba que sólo lo enviaban por mail, pero si lo publican en abierto ya no hace falta mantener el sigilo. Por si interesa a alguien, cada semana hacen un artículo similar, por tanto entiendo que en la web podrá consultarse.

A mi aquí: https://www.advisorperspectives.com/commentaries/2018/10/15/heartburn-not-a-heart-attack

Parece que les mola que les sindiquen el contenido a tutiplén.

Era de esperar esa respuesta

Desde fuera(no soy partícipe de Cobas) creo la respuesta de la empresa es de lógica aplastante.

Volatilidad versus riesgo

Los white papers del Jensen Quality Growth:

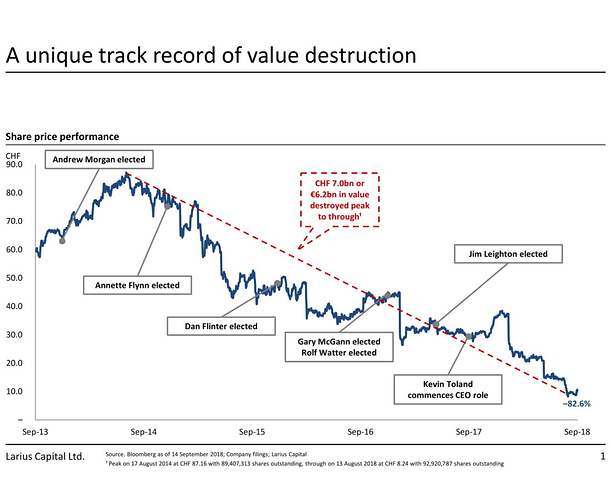

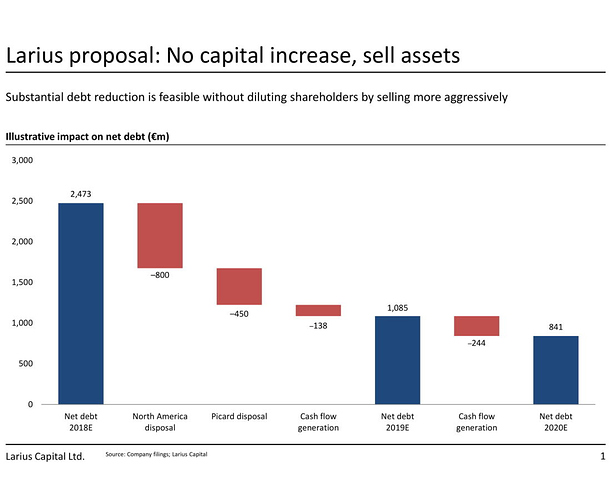

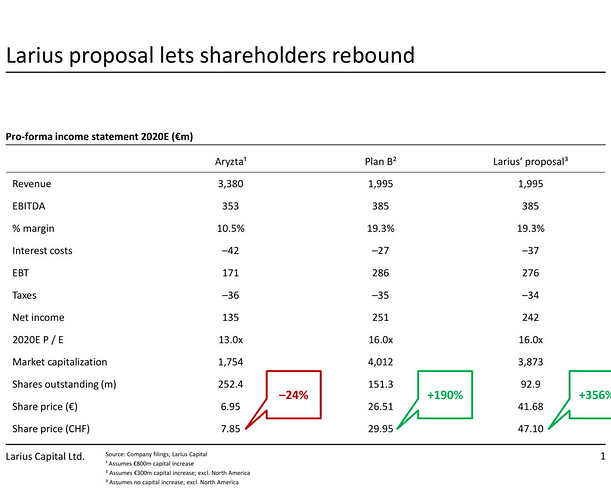

No veas con Mr Larius: Tiene la solución para mutiplicar la acción por 4 en un plis plas (¿Será taxista?), simplemente hay que hacerle caso y ni tan sólo hace falta ampliar capital.

A ver si luego se pone con OHL que yo pongo la coca cola y los cubitos.

Me ha parecido interesante, y me recuerda directamente algunas inversiones muy de moda últimamente

Significativo desinterés/desconocimiento por las finanzas

Cambio en la cartera de mi madre: Vendemos agradecidos a Silicom (“no te olvidaremos”) y compramos Bayer, al que nuestro algoritmo atomico secreto (reprogramado severamente despues de las compras de Groupe Guillin,Econocom y OHL) concede mayor potencial y margén de seguridad.

Desde que leimos este bonito cuento, esperabamos ilusionados la llegada de este momento.

https://greenlightuat.itgny.com/Download.aspx?ID=88718ece-a58e-4ffc-bedb-0d2c26cd1a6a&Inline=1https://search.norton.com/?o=APN11910&chn=Default&guid=8ad92664-e736-4054-a4a9-b45d4b6f72ee&doi=2018-01-19&prt=Default

A precios actuales no parece mala compra . Yo también compré unas cuantas mas a 67 eur.

Entre esta y OHL , me quedo con la primera

Muy buen video, calentito y salido del horno:

entre otras cosas utilizan derivados vendiendo opciones put, todas las preguntas y respuestas interesantísimas.

¡Una maravilla!

Tanto Los Valentum como Value School

Grupo ZENA compra VIPS

Y Koplowitz sale de Cobas y AZ (no sé cuanto tenía la verdad).

Una mirada muy crítica al value nacional

Interesante reflexión/resumen de Max Keiser de su programa Keiser Report los últimos años La economía mundial lleva muerta desde el año 2008

Yo podría escribir hablando de lo mismo y, aceptando que Aryzta es un error, decir justo lo contrario: que el value vivirá eternamente dando buenas rentabilidades.

Me parece arribista a más no poder el artículo.