También de manera rápida, los resultados del Q4 de BX, que han sido realmente buenos e indican el cambio de tendencia

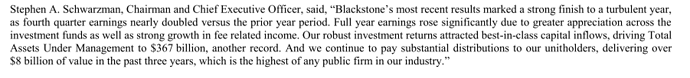

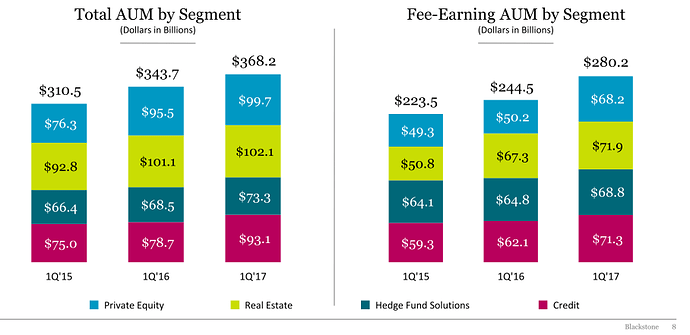

Los AUM han seguido aumentando, lo cual va en línea con la tesis inversora

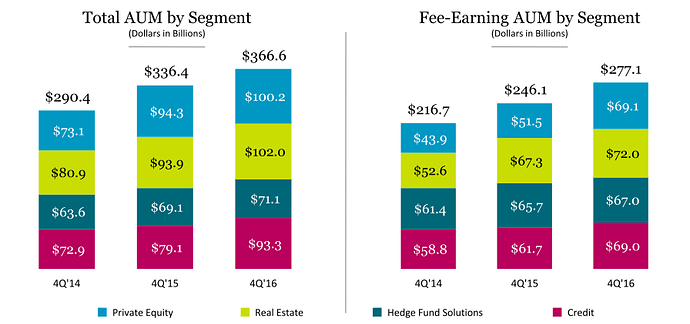

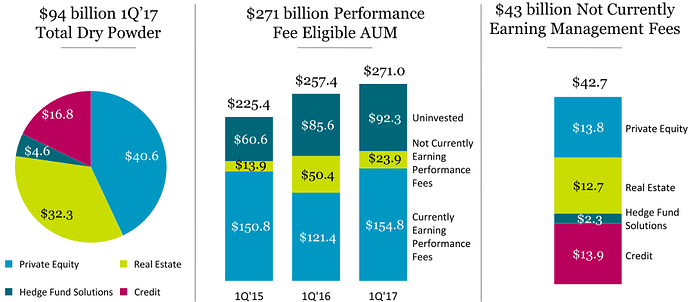

El capital para invertir disponible, se mantiene más o menos en el mismo rango

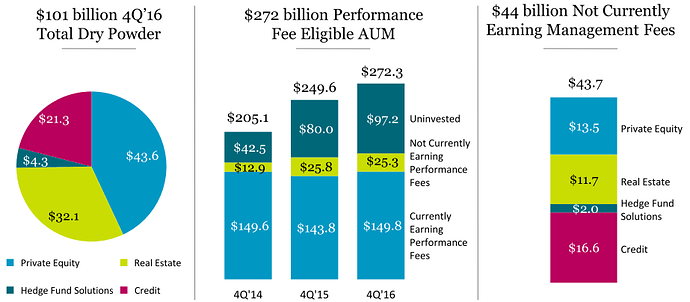

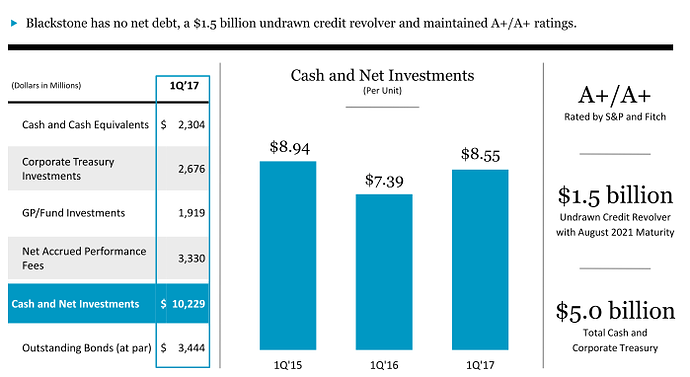

Siguen con bastante caja

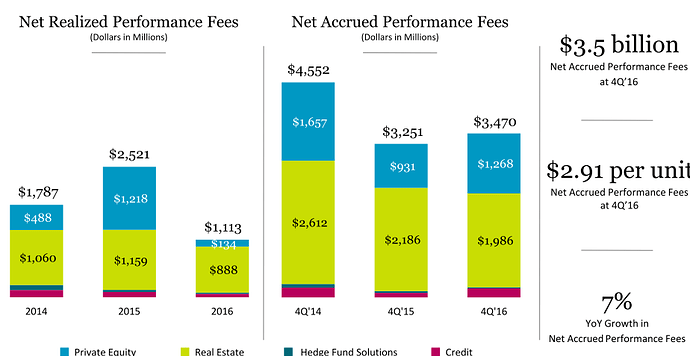

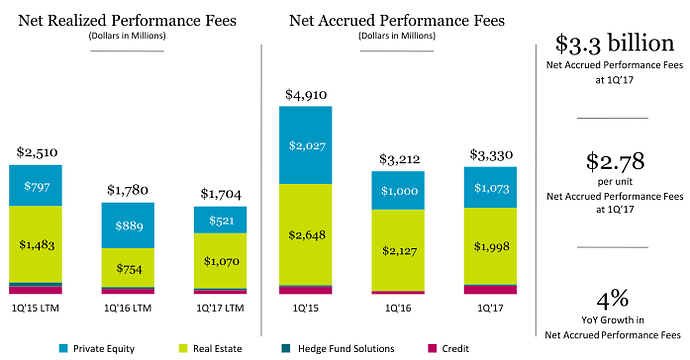

Los performance fees , han sido muy flojos, lo cual para mi es excelente, pues si con unos perfomance tan bajos, consiguen esta rentabilidad, en cuanto empiecen a florecer, como indican en el Transcript veremos un aumento considerable

Copio algunos párrafos de la transcripción:

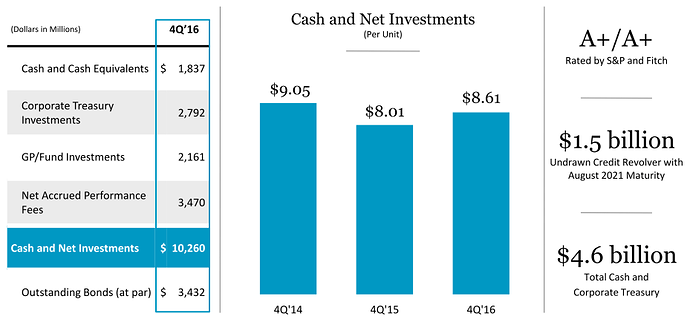

Stephen Allen Schwarzman - The Blackstone Group LP

Good morning and thank you for joining our call. Blackstone closed 2016 with strong fourth quarter results, as Weston just mentioned, and powerful momentum heading into 2017. Fourth quarter revenues and Economic Net Income rose by 79% and 86%, respectively. For the full year, revenue reached $5.1 billion, while ENI rose to $2.4 billion, both up 11%, as compared to only slight earnings growth for the broader market.

We generated full year cash earnings of $2.2 billion and continue to pay very healthy distributions to our unitholders. In fact, over the past three years, Blackstone has actually distributed over $8 billion in value to our unitholders, which is more than any other public firm in our industry, no one close. And we remain one of the highest yielding equity securities of any large company in the world.

…

In conclusion, looking forward, I envision excellent prospects for the next several years for our firm and for our limited partners. Our business is flexible and responsive to changing dynamics which is ideal for the period we’re entering. For our unitholders, we’re coming off a period of record fundraising, significant investment activity, and have a powerful near-term earnings trajectory which Michael Chae will describe to you in more detail.

Michael S. Chae

With respect to realizations, our pipelines are strong. We expect to remain very active. And, importantly, we start the year with great momentum in terms of DE from sales that are effectively locked in. Specifically, we currently have $8.7 billion in realization under contract or already closed in January that are expected to drive over $700 million or over $0.60 per unit in distributable earnings, most of which we expect to close in the first quarter.

These sales include the Hilton stake sell, transactions involving Change Healthcare, Optive, Pactera and our Japan residential portfolio among others and a number of significant public stock sales that have already been completed just in the first few weeks of the quarter. So, from where we sit in January, we see a very strong trajectory in terms of DE and cash distributions to our unitholders for the year.

Y aquí es donde viene la madre del Cordero. Si consiguen que con la nueva Administración Trump, los 401K puedan invertir en sus fondos, los AUM se dispararían.

Schzwarman

One thing I’d say, this is Steve, at the risk of prolonging this answer is that in life you have to have a dream. And one of the dreams is our desire and the market’s need to have more access at retail to alternative asset products. As I said in my prepared remarks, if you look at those returns, those are really stunning. And at the moment, a lot of people are not allowed to put those into retirement vehicles and other types.

One of the interesting issues when you have a new government is whether they want to continue that type of prohibition or not because what it’s doing is denying people sort of a better retirement. And if there is a change in that area, that becomes a huge opportunity for the firm. We already have lots of white space that Joan was talking about. So we’re not defective in terms of things to do every day to increase sort of penetration, but there is ability for something to get changed that could be really, really impactful. And we’ll see what happens with that.

Michael Roger Carrier - Bank of America Merrill Lynch

Yeah. That’s helpful. And then just as a follow-up, you guys mentioned a lot on the policy changes, whether it’s taxes, improving economic growth and what that means for the portfolio of companies. Just in terms of maybe fundraising opportunities with potential changes, like anything stick out? Tony, you’ve spent a ton of time on the retirement space, and what potentially could change or what the opportunity could be for you guys or for others in the industry?

_H_amilton E. James - The Blackstone Group LP

Well, I think Steve hit on it in his comments. The really big, vast, vast untapped territory is the $27 trillion that’s in 401(k)s that we don’t sell – we, as an industry, don’t sell anything into. So we – and I would say that severely penalizes 401(k) savers because they earn typically 2% to 3% on their money. There isn’t a pension fund in America that hasn’t earned more than 6% and their targets today are about 7% on average going forward. So you can see the cost, if you will, of forcing investors into short-term daily mark-to-market, daily liquidity, illiquid stuff (54:21). And if we could open up those pools of capital to our kind of investing, I can assure you that retiring Americans will be vastly better off, both short-term and long-term.

yo por ejemplo pensaba en los dos cliches de arriba y gracias a

yo por ejemplo pensaba en los dos cliches de arriba y gracias a