James Montier, autor de varios libros sobre finanzas conductuales y value investing, publicó en 2005 un paper titulado Seven Sins of Management: A Behavioural Critique.

Trata sobre los sesgos de comportamiento más comunes entre los inversores y gestores de fondos.

El paper puede descargarse gratuitamente aquí.

Lo siguiente es un resumen de algunas ideas interesantes recopiladas en un blog. Siento no traducirlas.

Abrazo.

Sin 1: Forecasting

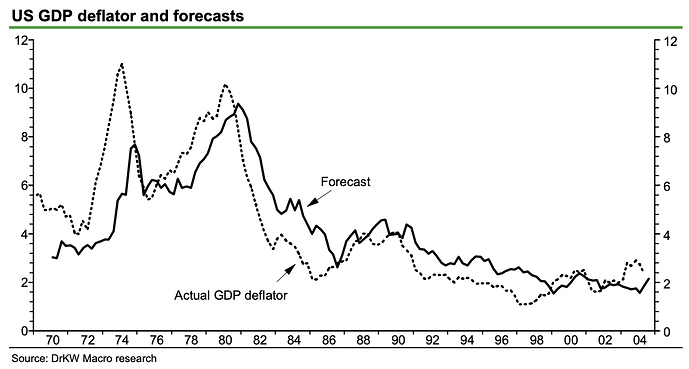

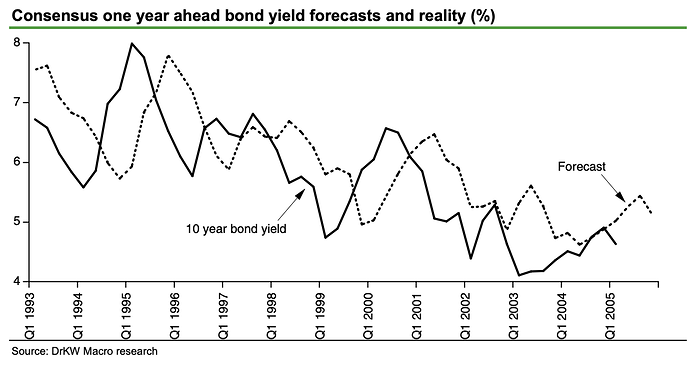

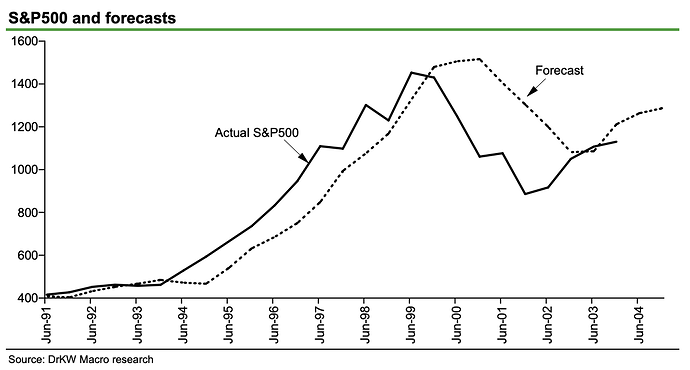

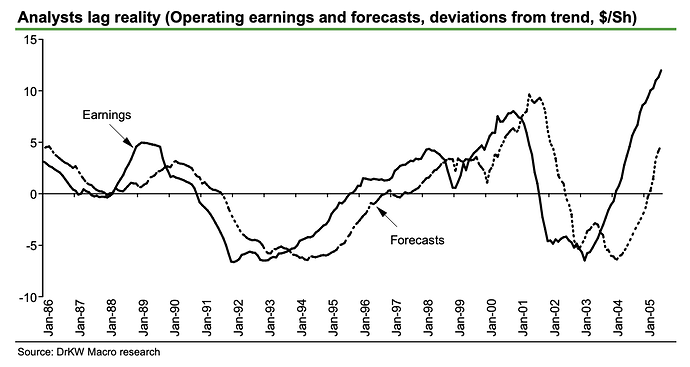

An enormous amount of evidence suggests that we simply cannot forecast. Montier suggests that anchoring bias and over-confidence cause investors to continue relying on forecasts in their investment decisions.

Sin 2: The illusion of knowledge

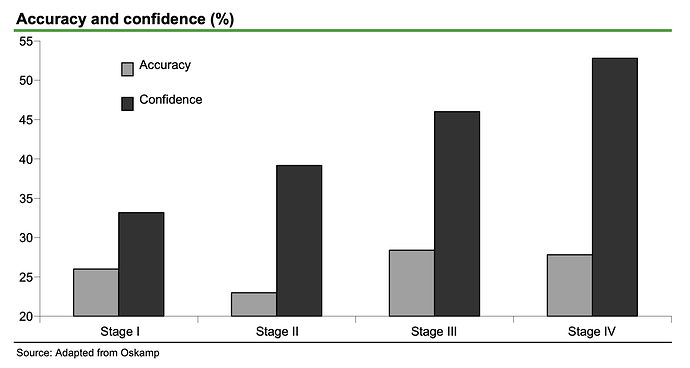

Investors appear to believe that they need to know more than everyone else in order to outperform. This stems from an efficient markets view of the world. If markets are efficient, then the only way they can be beaten is by knowing something that everyone else does not. This is paradoxical because it is the pockets of inefficiency that allow for outperformance. Due to our cognitive limits, he argues that more information, beyond a low amount, only increases confidence rather than accuracy.

Sin 3: Meeting companies

Meeting management is an important cornerstone in most fund managers’ investment process. However, there are five psychological hurdles that must be overcome for management meetings to value-add to an investment process and this significantly reduces the effectiveness of management meetings.

- The illusion of knowledge; more information is not better information

- Corporate managers suffer from biasedness as well

- Investors suffer from confirmatory bias, meaning they tend to look for information that agrees with them rather than asking questions that test their base case

- Investors have an innate tendency to obey figures of author

- Investors are lousy at telling truth from deception

Sin 4: Thinking you can out-smart everyone else

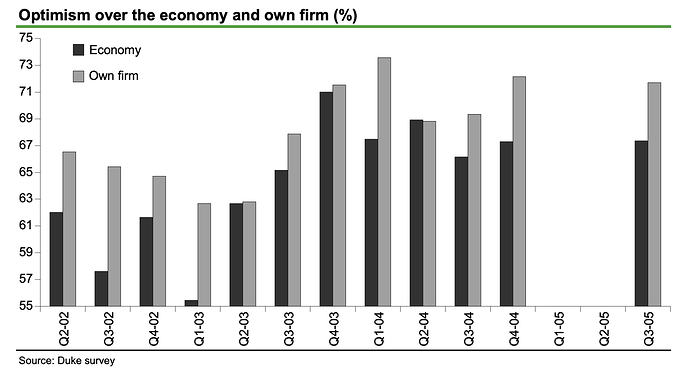

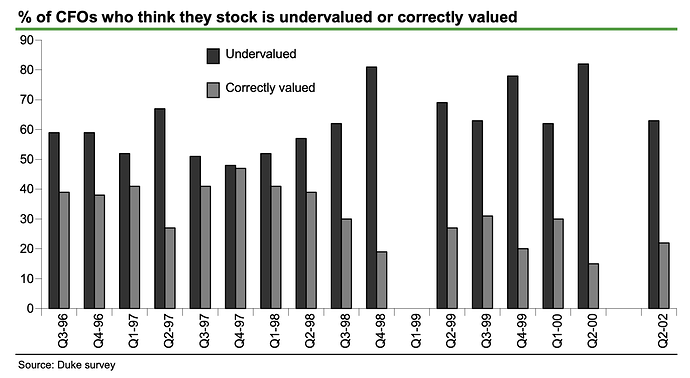

The two most common behavioural traits are over-optimism and over-confidence. However, the reality is that it is extremely difficult to be one step ahead of everyone else. Investors who base their investment decisions on such a belief are likely to err.

Sin 5: Short time horizons and overtrading

Many investors end up confusing noise with news in their bid to out-smart each other, ending up with ridiculously short time horizon. The average holding period for a stock on the New York Stock Exchange is 11 months.

Sin 6: Believing everything you read

Stock brokers often spin stories of growth in order to attract investors. More often than not, the growth fails to materialise. Unfortunately, Montier argues that humans are hard-wired to accept stories at face value. Investors need to be more sceptical of the stories they are presented with.

Sin 7: Group based decisions

Montier debunks the belief that groups are better at making decisions than individuals. The original idea is that group members will offset each other’s biases. However, social psychologists have found that groups actually amplify biases and are ineffective at uncovering hidden information. For example, members often enjoy enhanced credibility among their peers if they are consistent with the group view. Therefore, using groups as a basis for stock selection often diminishes performance