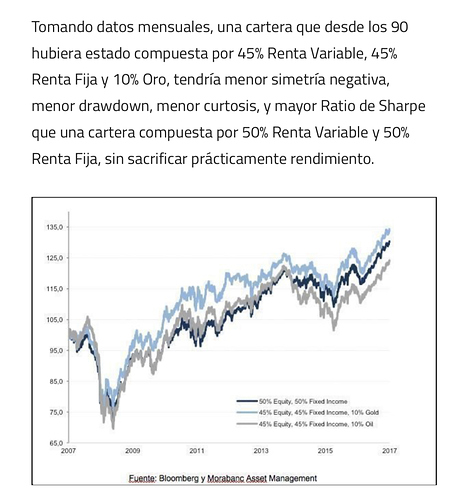

“Gold is an emotional topic for investors, and usually they fall on one side or another with a very strong opinion for or against. We think you should learn to become asset class agnostic and appreciate each asset class for its unique characteristics. Gold had the highest real returns of any asset class in the inflationary 1970s but also the worst performance from 1982 – 2013. However, adding gold (and to a lesser extent other real assets like commodities and TIPS) could have helped protect the portfolio during a rising inflation environment. Gold also performs well in an environment of negative real interest rates – that is when inflation is higher than current bond yields…”

Meb Faber “Global Asset Allocation”

2 Me gusta