Pues parece que sigue por ahí.

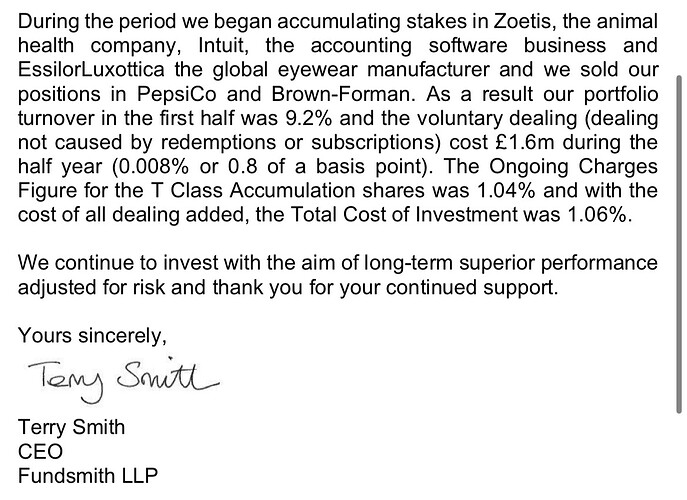

Dejo aqui el link a la carta completa

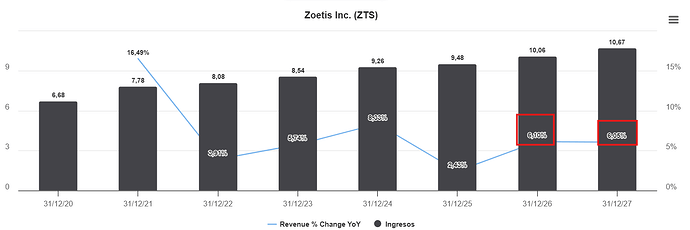

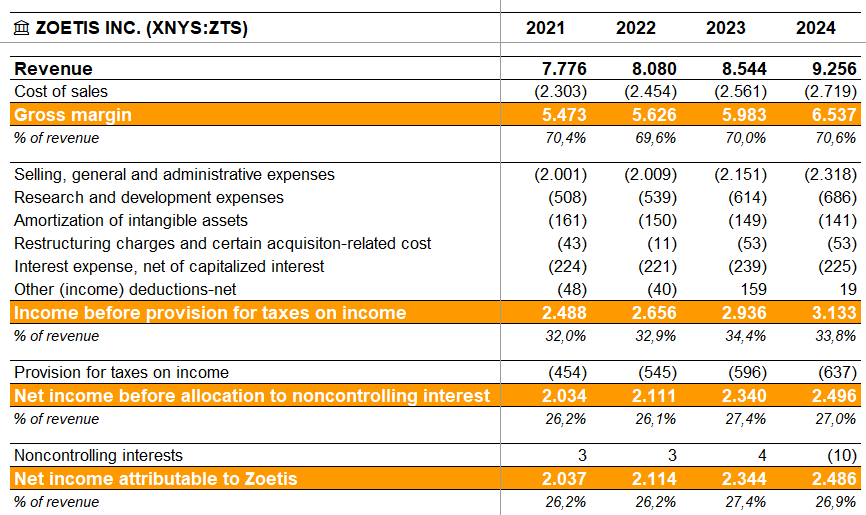

La acción desde que este hilo se abrió está plana (algo más de dos años). Mientras tanto ha ocurrido lo siguiente:

-Los ingresos han pasado de 7.776 a 9.256.

-El beneficio operativo a ha pasado de 2.488 a 3.133.

Ese 8% está ya más cerca del 10%.

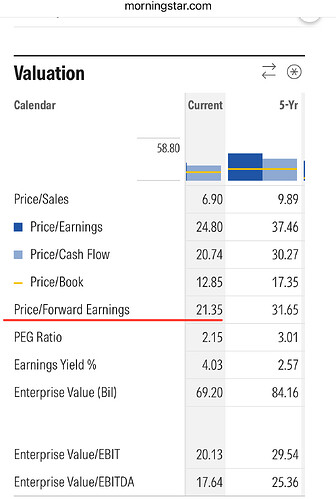

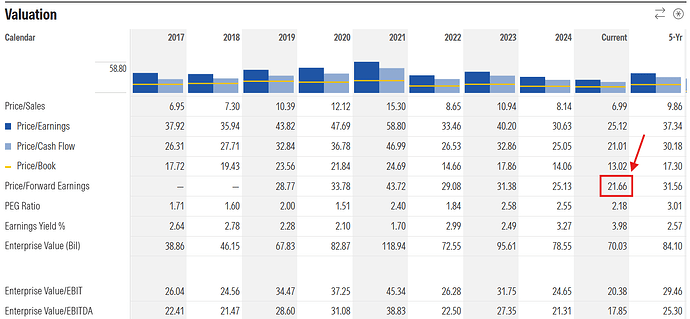

Valoraciones en mínimos.

Está la verdad para volverla a meter.

Tenemos hoy presentación, a ver qué nos cuentan.

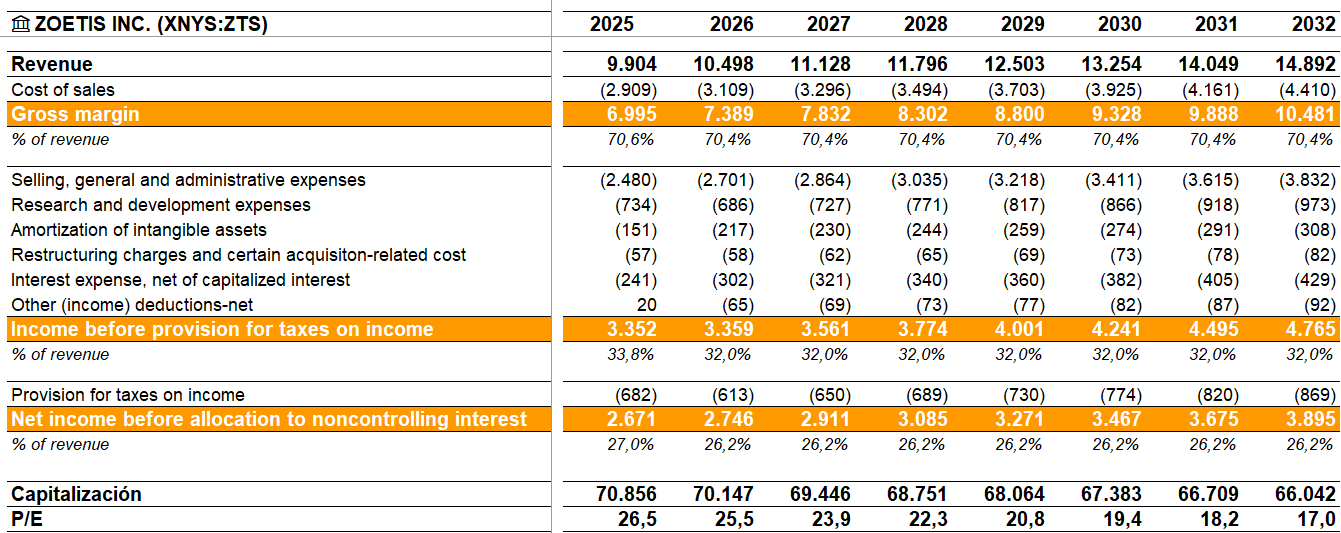

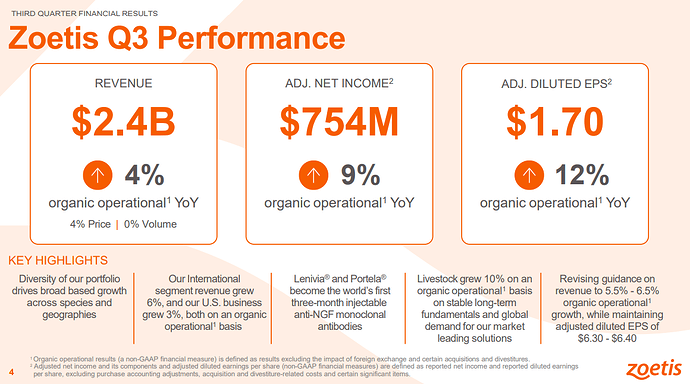

Recién salidos del horno:

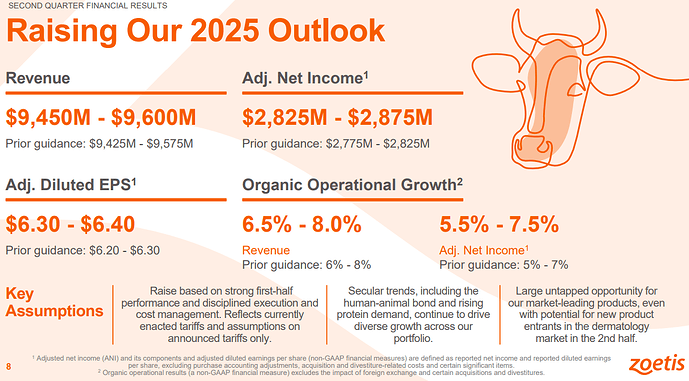

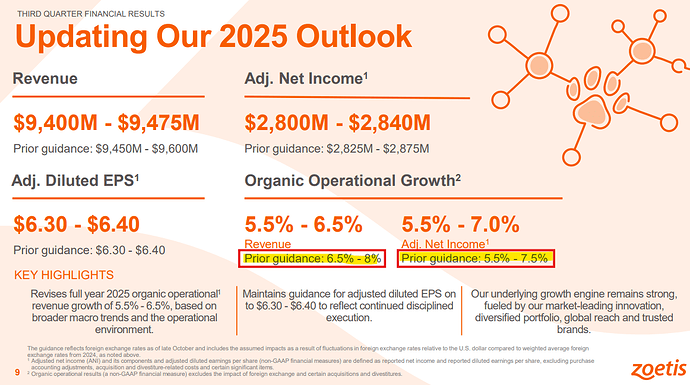

Actualizan guidance a nivel de ingresos:

-

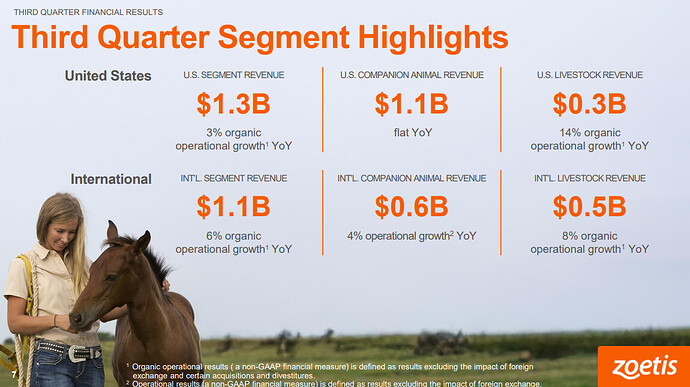

Revenue in the U.S. segment was $1.3 billion, a decrease of 2% on a reported basis and an increase of 3% on an organic operational basis compared with the third quarter of 2024. Sales of the company’s innovative companion animal products were flat for the quarter. Growth in the company’s parasiticides portfolio, including Simparica ® and Revolution ® franchises, diagnostics and key dermatology portfolio, including Apoquel ® Chewable, were offset by a decline in the company’s monoclonal antibody (mAb) products for osteoarthritis (OA) pain, Librela ® for dogs and Solensia ® for cats. Sales of livestock products declined 9% on a reported basis in the quarter, largely due to the divestiture of the medicated feed additive (MFA) product portfolio and related assets. On an organic operational basis, sales of livestock products increased 14% with strength in the cattle portfolio driven primarily by improved supply of ceftiofur products and growth across the broader livestock portfolio, primarily in vaccines.

-

Revenue in the International segment was $1.1 billion, a 3% increase on a reported basis and a 6% increase on an organic operational basis compared with the third quarter of 2024. Sales of the company’s innovative companion animal products grew 8% on a reported basis and 4% operationally 3. Growth in the quarter was driven by the company’s parasiticides portfolio, including both Simparica and Revolution/Stronghold ® franchises, as well as key dermatology products Apoquel ® and Cytopoint ®. Sales of livestock products declined 2% on a reported basis, due to the divestiture of the MFA product portfolio and related assets. Sales of livestock products increased 8% on an organic operational basis, driven by broad-based growth across all core species.

INVESTMENTS IN GROWTH

Zoetis continues to advance care for animals across the globe with a robust pipeline fueled by lifecycle innovation, geographic expansion and disruptive innovation. As noted at the JP Morgan Healthcare Conference in January, the company expects to receive a significant approval in a major market every year for the next several years. The company will host an Innovation webcast on Tuesday, December 2 at 8:30 a.m. ET to provide investors with updates and progress related to its pipeline, and details about Zoetis’ strategic approach to addressing unmet needs, industry-leading R&D capabilities and potential for long-term growth.

A ver qué cuentan el mes que viene.

Pues -10% en preapertura

Y yo sin cash, de nuevo ![]()

He vendido unas pocas Miquel y Costas que tenía para poner orden a 120$. A ver si entra.