Por si puede ser de interés a los lectores y a @camacho113, autor de este trabajado artículo, les adjunto vínculo al análisis de Morningstar actualizado ayer mismo 3 de Mayo:

Como quizás no permita leerlo a los no suscritos, me perdonarán que copie el texto del mismo a continuación, a riesgo de hacerlo un poco largo:

A Torrent of Transitory Cost Pressures Continue to Strangle Clorox’s Profits; Shares Attractive

Erin Lash

Sector Director

Analyst Note | by Erin Lash Updated May 03, 2022

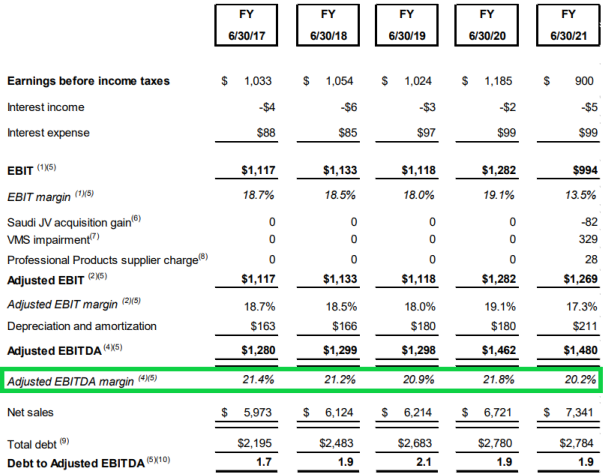

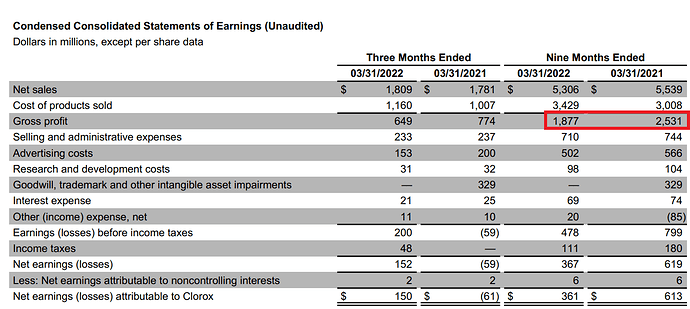

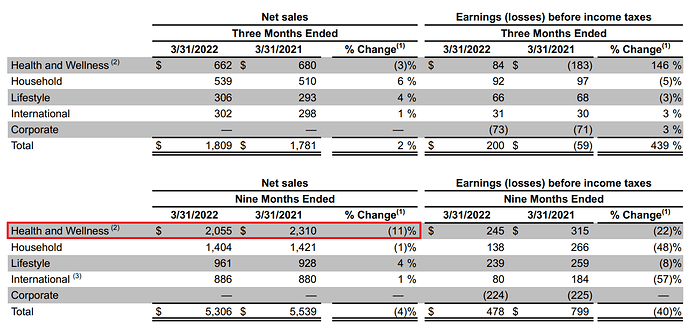

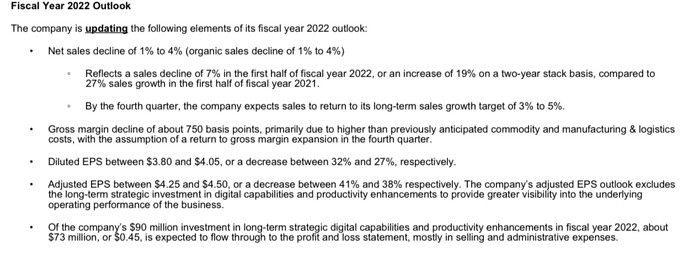

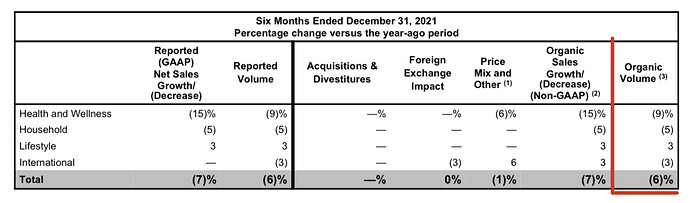

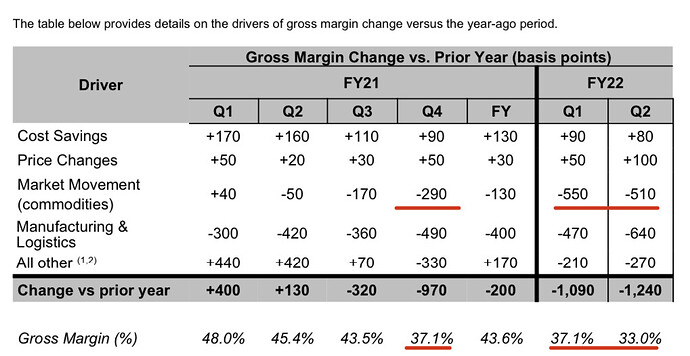

The foremost concern ahead of Clorox’s fiscal 2022 third-quarter print was the extent to which inflationary pressures would affect its gross margin. And despite posting a 760-basis-point degradation in gross margin (reflecting a 410-basis-point contraction stemming from commodities and 570 basis points from manufacturing and logistics), the 35.9% posted was nearly 300 basis points above the prior quarter, suggesting Clorox’s efforts to increase prices and reduce inefficiencies (a 270-basis-point benefit in aggregate this quarter) to dull the profit hit are starting to gain traction. We view this as particularly encouraging against a backdrop whereby cost pressures are being exacerbated by the crisis in Ukraine. The volatile global political and economic environment prompted Clorox to now guide for an 800-basis-point pullback in its fiscal 2022 gross margin due to $530 million in incremental commodity, manufacturing, and logistics costs, $30 million above previous expectations.

However, we don’t think Clorox is sitting still. Rather, to deflect the higher costs, management intends to take prices up across a swath of its mix, slated to hit shelves in July (its third round since the fall of 2021). We also surmise natural accretion should manifest as the firm brings more manufacturing in-house (versus the utilization of higher-cost co-manufacturers employed during the pandemic).

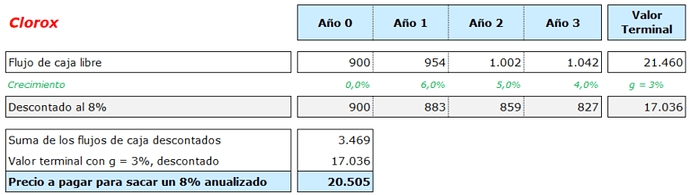

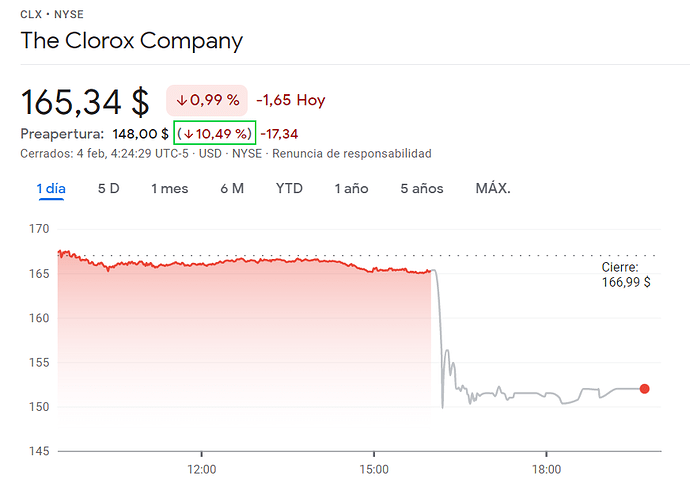

With just three months left in its June-ending fiscal year, management held the line on its top line (a 1%-4% sales decline) but tempered its near-term profit prospects, now calling for adjusted EPS of $4.05-$4.30 ($4.25-$4.50 prior). Commensurate with this, we intend to prune our near-term earnings outlook ($4.35 preprint), but when married with time value, we don’t expect a material change to our $161 fair value estimate. Shares trade at a 10%-15% discount to our intrinsic valuation, and we think investors should consider building a position in this wide-moat name.

Business Strategy and Outlook | by Erin Lash Updated Feb 10, 2022

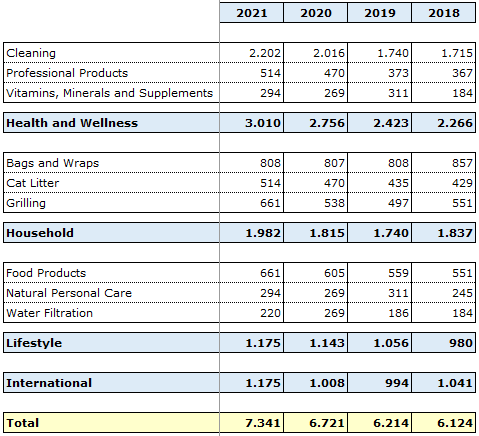

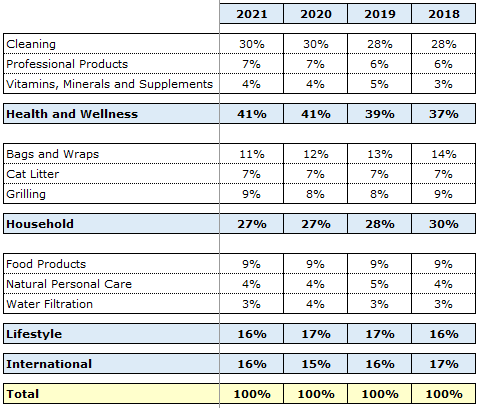

The pandemic prompted consumers to scour the shelves for Clorox’s fare, boosting sales. And even as volume growth is decelerating, we don’t think consumers are turning their backs on Clorox’s cleaning and disinfecting products, as sales remain well above where they were before the pandemic. For one, its health and wellness arm (around 40% of sales, housing its retail and professional cleaning operations) was up 20% in the first and second fiscal quarters on a two-year stack basis. Further evidencing the strength of its brand mix, Clorox just posted its second consecutive quarter of double-digit market share gains in the disinfecting wipes aisle.

And we expect management will continue investing to ensure its prowess holds. In this context, Clorox intends to invest $500 million over the next five years to bolster its digital capabilities (in light of the stepped-up e-commerce adoption that has taken hold throughout the pandemic) and to look for additional productivity advancements throughout the organization, which we view as a prudent way to fuel further investments.

But Clorox (along with a host of players in an array of industries) is facing a rampant surge in broad-based cost pressures (qualitatively referred to as unprecedented relative to the last few decades). In this vein, management indicated higher manufacturing and logistics costs were a 640-basis-point drain in the second quarter, and commodity price inflation ate into gross margins by another 510 basis points. Despite this, we’re encouraged that its rhetoric suggests investments in innovation and marketing will still take top billing from a capital allocation perspective, which we view as judicious. Our forecast calls for Clorox to expend a low-double-digit percentage of sales toward research, development, and marketing on an annual basis. We view this spending as particularly critical against the current backdrop (elevated inflation and intense competition). More specifically, Clorox goes to bat with lower-priced private-label offerings in most of the categories in which it plays, but we think investments in innovation and marketing should help its fare stand out on the shelf and stifle trade down.

Economic Moat | by Erin Lash Updated Feb 10, 2022

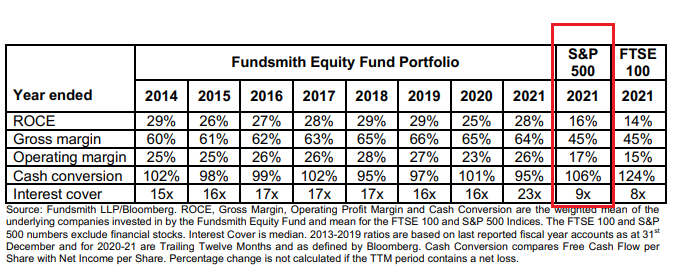

We assign Clorox a wide moat based on its brand intangible assets and cost advantages. The company’s return on invested capital has been 25%-35% for each of the last 10 years, coming in at nearly 30% (including goodwill) in fiscal 2021. We forecast ROIC to average 32% annually over the next 10 years, more than 4 times greater than our 7% cost of capital estimate and supporting our stance that the firm has amassed a sustainable competitive edge.

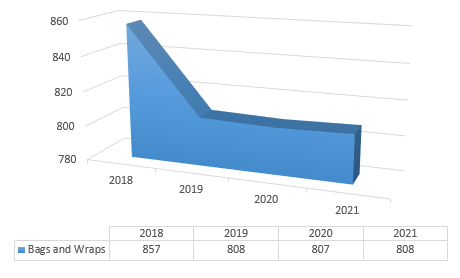

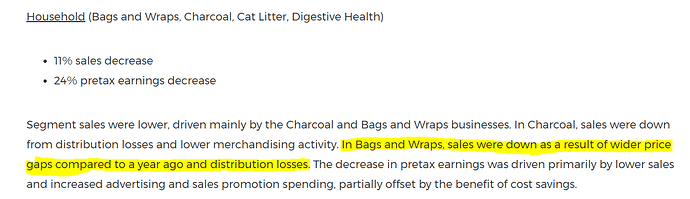

Even though it faces outsize competition from private-label offerings, around 80% of Clorox’s U.S. sales are from brands that are number one or two in their categories. Clorox has carved out a significant share position in bleach (nearly 60%), charcoal (54%), and trash bags (30%). It also leads in salad dressings (excluding mayonnaise), water filtration, and disinfecting wipes. Clorox has been able to maintain these leading positions with little movement in market share over the last five years, which we think makes the company a valued partner for retailers, lending credence to its intangible asset moat source.

Clorox continually looks to strengthen its brands, emphasizing innovation and marketing to differentiate its fare. It consistently spends more than 2% of its revenue on R&D–more than industry peers Colgate-Palmolive and Kimberly-Clark and just behind Procter & Gamble (five-year averages of 1.8%, 1.6%, and 2.7%, respectively)–while also spending to market these offerings in front of consumers (around 10% of sales annually), because even value-added new products can fail to win at the shelf if consumers aren’t aware of them. And although demand has stepped up with consumers’ penchant for home and personal cleaning fare for the better part of the past two years as a result of concerns surrounding COVID-19, we’re encouraged that Clorox continues to lean into advertising as a way to ensure its products stay top of mind, expending nearly 11% of sales in this regard in fiscal 2021. Further, innovation isn’t merely targeted at the low end. Features Clorox has added to trash bags include scents, leak guards, and extra strength, which has enabled the company to grow to greater than 50% share in the premium trash bag category, which boasts higher margins and faster growth than the trash bag category overall.

In our view, the constant innovation and customer awareness campaigns solidify Clorox’s mix in consumers’ minds as quality, trusted brands, and we think the combination of its portfolio of leading brands and the resources it maintains to reinvest to drive traffic to brick-and-mortar outlets and e-commerce platforms entrenches its relationship with its retailer partners.

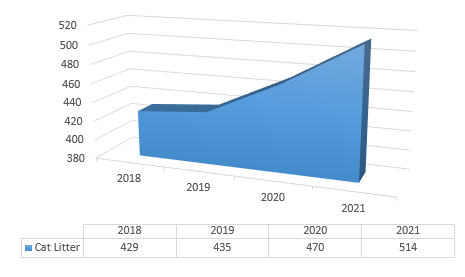

We also believe the company has a cost edge over its smaller competitors. Its adjusted operating margins (18% on average over the last five years) compare favorably with those of Procter & Gamble (22%), Kimberly-Clark (18%), and Colgate-Palmolive (25%), which are larger companies with greater scale. In addition to scale benefits relative to its smaller competitors, Clorox garners cost advantages through its sourcing and logistics. It co-owns mines to obtain specific clay for its cat litter products, and it procures charred wood, the main raw material for charcoal, from mills located in close proximity to Clorox’s manufacturing facilities. Further, Clorox is focused on bringing to market new value-added products that cost less to manufacture, such as compacted bleach, lightweight charcoal, and lower-resin trash bags.

In light of its brand intangible assets and cost edge, we are confident that Clorox’s returns on invested capital will continue to exceed the company’s cost of capital for the next 20 years, and we stand firm on our wide moat rating.

Fair Value and Profit Drivers | by Erin Lash Updated Feb 10, 2022

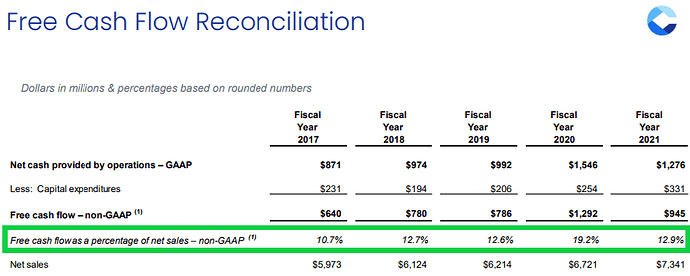

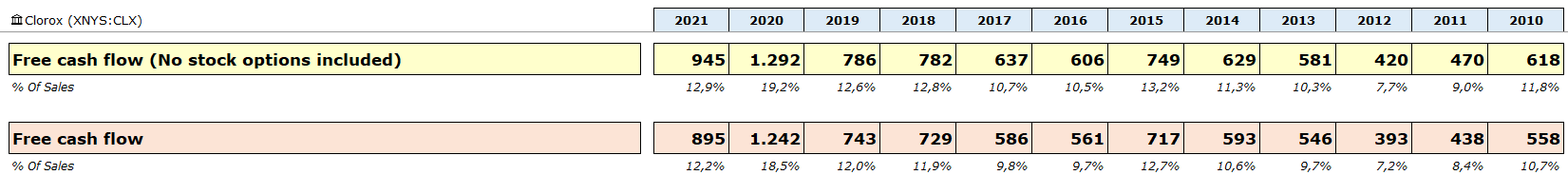

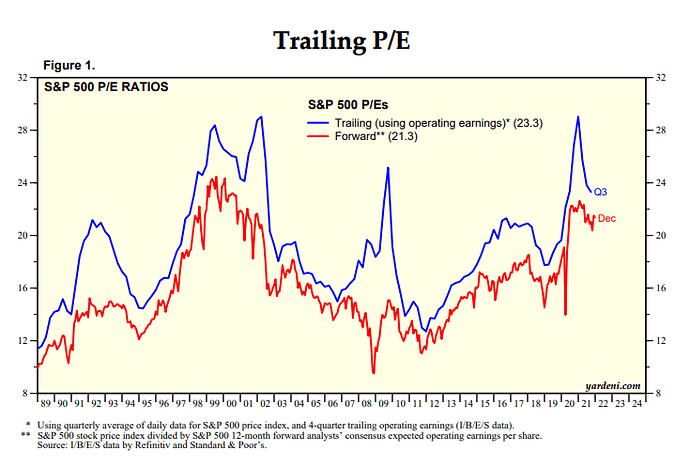

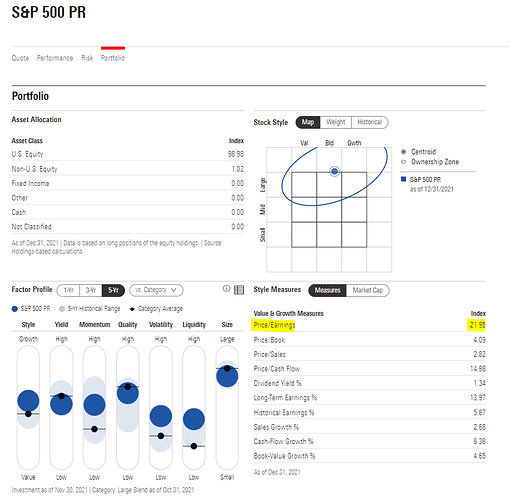

Even as Clorox slashed its fiscal 2022 adjusted EPS target to $4.25-$4.50 from $5.40-$5.70 (and we tempered our forecast to $4.34 versus $5.55 preprint), we’re holding the line on our $161 fair value estimate after accounting for our revised U.S. corporate tax rate expectations (5% lower) and time value. Cost pressures (transportation, logistics, and commodities) are wreaking havoc on profits, and Clorox expects the most austere gross margin in fiscal 2022 that the firm has chalked up in decades (in the high-30s versus the 44% levels it has averaged over the past five- and 10-year periods and the nearly 46% it chalked up in fiscal 2020).

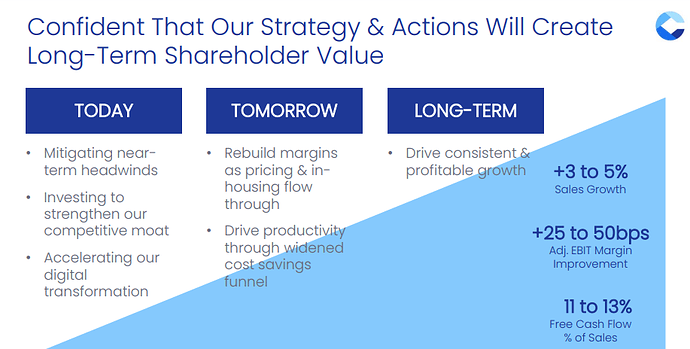

Despite these near-term challenges, we still think Clorox is employing a tactical approach, anchored in investing in consumer-valued innovation supported by advertising, pursuing cost savings, and surgically taking price (aiming to hit about 85% of its mix in the current fiscal year), which we view as prudent. As such, we aren’t altering our long-term forecast for 3%-4% annual sales growth and operating margins approaching 20% by the end of the next 10 years (a touch above the level achieved in fiscal 2020). Our valuation implies a fiscal 2023 enterprise value/adjusted EBITDA of 20.

We concede consumers’ proclivity for personal and household cleaning is likely to persist in the near term, propping up sales in these aisles the next several quarters (relative to prepandemic levels). However, over the medium to longer term, we don’t think this lofty trajectory has staying power, particularly as concerns about the virus ultimately fade. Further, we don’t expect promotional spending will remain dormant over a longer horizon (as has been the case since March 2020, given the extent to which demand has outpaced supply in categories throughout the store), as competitors muscle for share gains, which should lead to decelerating sales growth.

Even before the pandemic, Clorox had started on a path to fuel improvement in its mix, anchored in spending behind innovation and marketing to more effectively align with consumer trends that should steady the business over time. We think the company’s ability to manage costs while still fueling brand spending (we forecast around 10% of sales spent on advertising and 2%-2.5% spent on R&D annually, equating to about $1 billion in aggregate annually) will support operating margins averaging in the high-teens (generally in line with its historic average).

Risk and Uncertainty | by Erin Lash Updated Feb 10, 2022

Clorox faces a number of risks in the highly competitive consumer packaged goods space. For one, consumers make frequent purchases and typically face no switching costs; firms must continually invest behind their brands to drive sales. In several categories, Clorox’s primary competition is private-label fare, so product innovation and marketing support are essential to ensure differentiation from these lower-priced offerings.

Greater consumer acceptance of private label, whether due to an economic downturn or consumer preferences, could threaten Clorox’s margins and/or sales growth. However, we think its business has proved resilient even in recessionary climates, as evidenced by the mid-single-digit quarterly organic sales growth posted in 2008-09. Despite reports that younger generations are more likely to accept private-label products at the expense of brands, Clorox seems to be withstanding these pressures, as it has posted low- to mid-single-digit annual sales growth over the last several years and about 200 basis points of operation margin expansion since fiscal 2012 (relative to the five-year average), to the high teens. But if its new products fail to resonate with consumers, results could falter.

Clorox also is subject to input cost volatility, which is again proving an obstacle. The company could face sustained margin erosion if it refrains from passing these costs on to consumers. Conversely, if it seeks to maintain profits, it could be subject to deteriorating volume if consumers balk at higher prices.

From an environmental, social, and governance perspective, similar to its peers, Clorox could be challenged if it is forced to recall its fare due to quality concerns. In addition, with a portion of its production occurring in regions where water is a scarce resource, Clorox may be challenged by impediments to its production process. However, given its diversified manufacturing network, we don’t anticipate this would be a meaningful constraint long term.

Capital Allocation | by Erin Lash Updated Feb 10, 2022

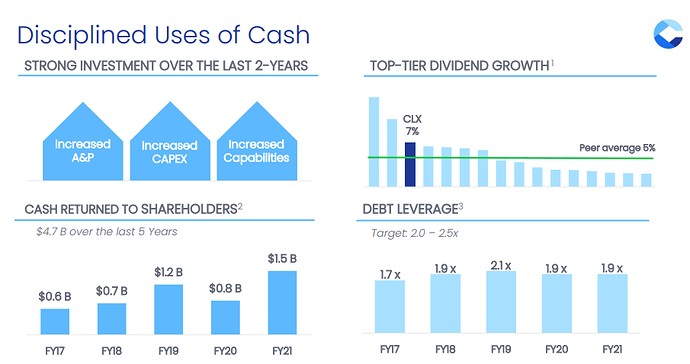

We assign Clorox an Exemplary capital allocation rating, premised on its sound balance sheet, appropriate shareholder distributions, and investments we find as fair.

Leverage isn’t a concern; net debt/EBITDA has held below 2 times since fiscal 2013, and we forecast that this will remain the case on average over the duration of our explicit forecast. We contend its solid balance sheet appears even more pristine when juxtaposed with the low cyclicality that Clorox boasts from a top-line perspective.

Even though CEO Linda Rendle has endured an onslaught of challenges since taking the helm in September 2020, we think Clorox’s strategic road map and capital allocation priorities are well founded. When she moved into the corner office, Clorox was flying high as consumers gravitated toward its mix of cleaning and disinfecting fare. However, the dissemination of vaccines (particularly in its home market–more than 80% of total sales) combined with a rampant surge in broad-based cost pressures (qualitatively referred to as unprecedented relative to the last few decades) has constrained sales and profits of late. Despite this, we think the firm is pursuing opportunities to beef up its competitive standing over a longer horizon. In this context, Clorox announced its intentions to invest $500 million over the next five years to bolster its digital capabilities (in light of the stepped-up e-commerce adoption that has taken hold throughout the pandemic) and to look for additional productivity advancements throughout the organization, which we view as a prudent way to fuel further investments.

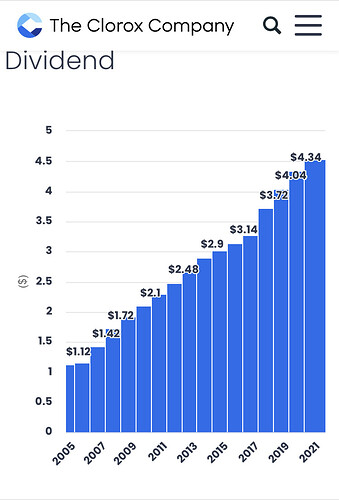

The jolt in demand for disinfecting wipes and cleaners since the spring of 2020 has put Clorox in a constrained supply position, and the company has yet to entirely catch up. To rectify the dislocation, management has been pursuing a multiprong approach that has included investing in its own manufacturing footprint as well as working with third-party manufacturers. However, we don’t believe its recent investments will saddle the business with excess capacity over a longer horizon. Our conversations with management lead us to believe that Clorox intends to build capabilities to meet 75%-85% of its demand outlook with a planning cycle that extends over the next three to four quarters–a wise approach, in our view, that should ensure that the company maintains the resources to reinvest in its operations while also juicing shareholder returns through dividends and share buybacks. We forecast that dividends will grow at a mid-single-digit clip each year through fiscal 2031 (maintaining a payout ratio of around 60% in the longer term), while the company also repurchases a low-single-digit percentage of shares outstanding annually, which we view as prudent when shares trade at a discount to our assessment of intrinsic value.

Beyond investing behind its existing operations, Clorox has also prudently pursued select inorganic opportunities from time to time to bolster its competitive standing. For one, the firm purchased Burt’s Bees in 2008, and although the timing was not optimal, the brand has turned into one of Clorox’s fastest growers (before the pandemic). Management has long shown a clear understanding of where its competence is and which companies and brands are best suited as acquisition targets–with its focus centered on small to midsize tie-ups where the sales base is concentrated on its home turf and which possess leading brands in faster-growing categories, such as natural personal care and health and wellness (given its established competitive edge in these categories and markets)–and it adheres to those criteria while closely scrutinizing valuation. However, we don’t believe the company is merely looking to drive top-line growth at any cost, as it opted to abandon its unprofitable Venezuelan business in 2015 and sold its noncore Armor All brand in 2011.

![]()

.

. :

: